Two of the world’s most influential artificial intelligence (AI) companies in the world just reported earnings.

And the results were… mediocre.

But the market was expecting great results.

So what happens next?

Will AI continue to drive the market in the months to come… or run it off a cliff?

Today, let’s answer the question everyone is asking.

The companies we’re going to review today are ASML (ASML) and Taiwan Semiconductors (TSM).

ASML is a Dutch semiconductor manufacturing equipment company. It dominates the industry with the most advanced chip manufacturing technology responsible for the world’s most bleeding edge chips.

Basically, all of the AI-specific semiconductors are manufactured using ASML’s technology.

TSM is the world’s largest semiconductor manufacturer. TSM is the largest customer of ASML. Different from ASML, TSM specializes in manufacturing and packaging of semiconductors.

Nearly all of the world’s semiconductor companies, large and small, rely on TSM to manufacture some or all of their semiconductor designs. This is especially true for AI-specific semiconductor companies that have a strong tendency to outsource their semiconductor manufacturing to TSM.

Without these two companies, our world would look very different.

We’ll get into more detail in a minute. First, I want to show you how the market reacts to the earnings of these two market leaders.

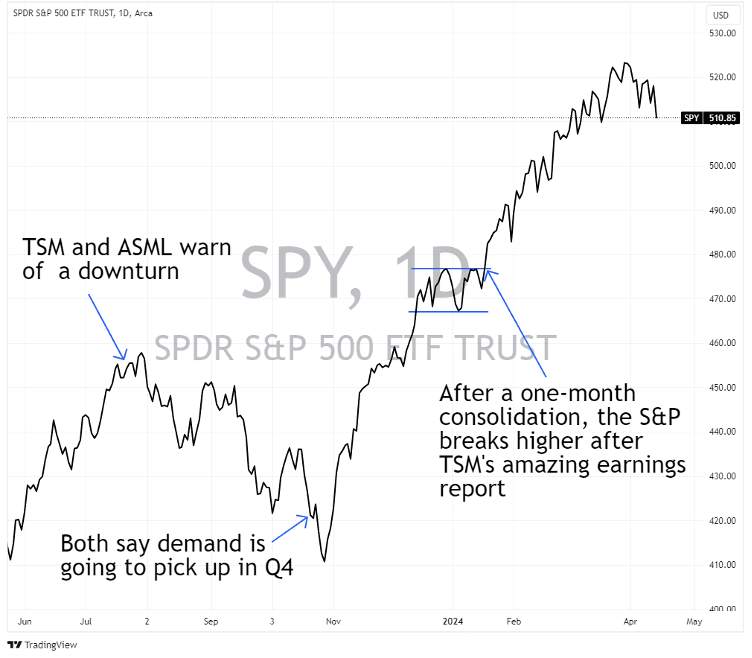

In the chart below, we can see how the S&P 500 Index reacted the last three times these companies reported earnings. We could go back even further and see a similar pattern.

And the pattern is clear: The market took its cue from these two companies.

Now, the market is waiting for a group of stocks to take the leadership role again.

And the results from these leaders tell us to expect more volatility.

First, for those who missed yesterday’s Outer Limits, let me introduce myself. I’m Nick Rokke. Long-time subscribers of Jeff’s work may recognize me from the Brownstone Research days. I served as Jeff’s lead senior analyst on his flagship large-cap tech stocks advisory, The Near Future Report.

When I heard Jeff had a heavy travel schedule, I jumped at the chance to share some of my research with everyone. I’m excited to be back. And I look forward to sharing more of my research with everyone.

Another one of the keys to our market beating returns in The Near Future Report was spotting the biggest oncoming mega trends of the day. Back in 2018, we invested heavily in the market leaders that were critical to the 5G wireless network buildout.

And then in 2020 after the pandemic, cloud computing companies led the way. It was clear the pandemic changed how we would work… and more compute would happen in the cloud.

After ChatGPT was first released at the end of 2022, the leaders have been AI companies. And that will continue to be the case until something more exciting comes along (which is unlikely anytime soon).

Being in these leading trends increases our odds of outperforming the market… and helps us identify the overall market direction.

As I said earlier, ASML and TSM are two of the three most influential AI stocks. The other being Nvidia (NVDA).

Any serious technology analyst must follow developments at these companies… and there are thousands and thousands who do, making decisions based on past performance of these companies and future expectations. Those decisions are what ultimately drive markets.

We’re exploring ASML and TSM today because they led off the quarterly earnings cycle for AI-related companies this week.

ASML is a unique company that holds a virtual monopoly in the semiconductor supply chain.

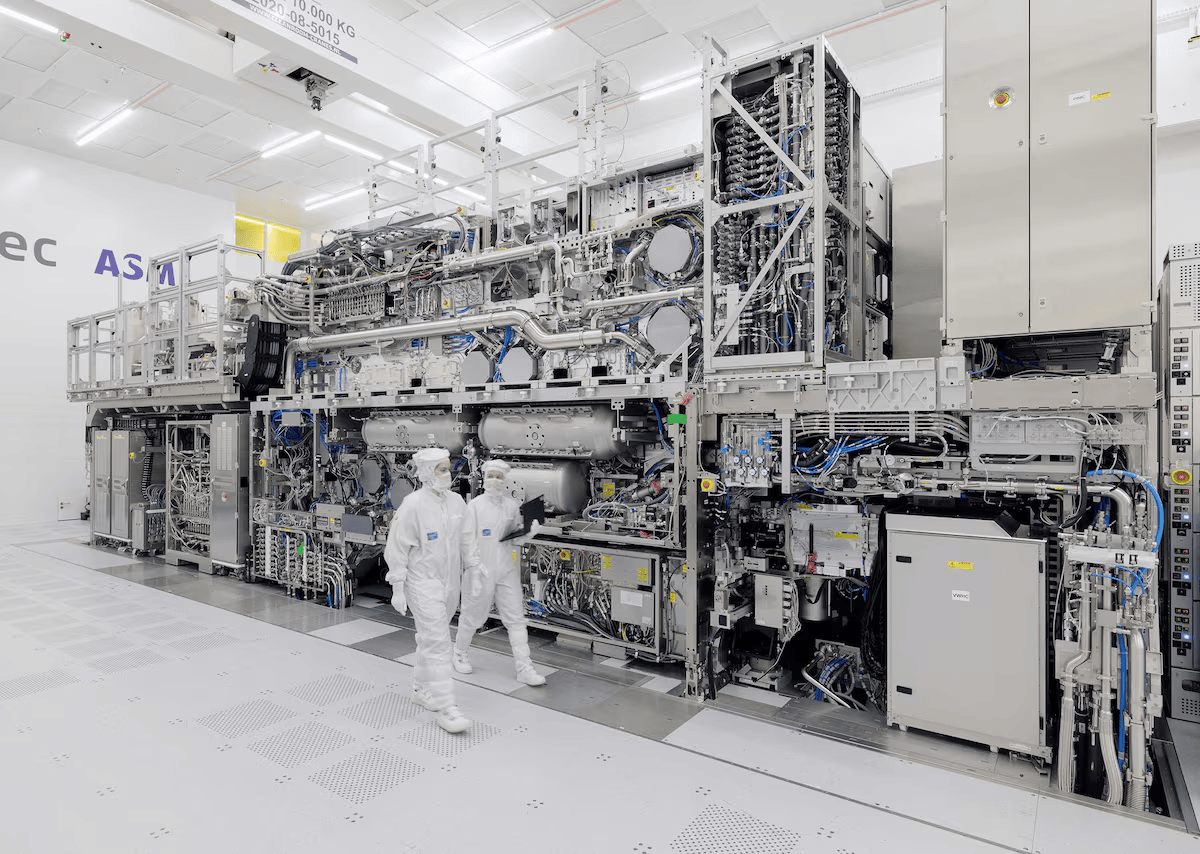

It’s the only company that manufactures extreme ultraviolet (EUV) lithography machines. These machines use fine lasers to etch circuit patterns onto the silicon wafer. The finer the lines, the smaller the transistors can be.

Smaller transistors packed more tightly together makes semiconductors more efficient. These EUV machines are the only machines that can make the bleeding edge, 5-nanometer (nm) and 3nm semiconductors.

Any semiconductor company in the world producing leading edge semiconductors relies on ASML’s EUV machines. Many industry reports expect huge growth in the semiconductor market, with estimates ranging between 18-40% annual growth in the coming years…

And ASML has a monopoly on the next generation of lithography, called high-NA lithography. (The “NA” stands for numerical aperture.) This optical system will get us to the 2nm node and below. The 2nm chips will be about 15% faster and use 30% less power consumption than 3nm semiconductors.

Here’s a picture of one of the new High-NA machines.

These machines cost about $380 million and weigh as much as two Airbus 320 jumbo jets. ASML just delivered its first one to an Intel factory, which will begin operation in late 2025.

ASML is an integral part of the semiconductor supply chain. And they won’t have any serious competition in the foreseeable future, due the highly specialized engineering processes and intellectual property portfolio owned by ASML.

Because of that, every semiconductor fabricator manufacturing at the 5nm node and below needs to order from ASML.

Listening to ASML’s earnings will tell us a lot about the demand for producers of AI semiconductors. If they see a slowdown in orders, or their backlog shrinks, that’s a bad a sign.

And as reported this week, ASML badly missed its orders estimate. ASML was predicted to have €4.6 billion in net bookings this past quarter, but the number came in at €3.6 billion.

This is why ASML fell after earnings. And the market fell with it, because it signifies that semiconductor fabricators may see a short-term slowdown ahead.

And that’s what we saw with ASML’s biggest customer — Taiwan Semiconductor (TSM).

TSM produces about 50% of the world’s semiconductors and 90% of the advanced node semiconductors (5 nm and smaller).

They produce the Nvidia A and H series GPUs, which are used by most AI researchers at this point. And they also produce competing chips manufactured by AMD, Apple, Google, Meta Networks, and Amazon — all “fabless” companies, meaning they design, market, and sell their own chips, but do not manufacture them. (Jeff covered the fabless explosion here in Outer Limits — The $7 Trillion Investment of a Lifetime.)

These companies chose TSM because it is the world’s most advanced semiconductor manufacturer. No other semiconductor foundry has anywhere near the scale as TSM, and that also means that TSM has the best economics.

Because all these companies use TSM for their cutting-edge chips, TSM’s earnings tell us about the end-demand for these chips. If TSM sees a slowdown in orders, it’s likely many other companies will see a slowdown in their revenue and earnings, as well.

TSM said that demand for AI-related chips remained strong. And they expect demand for these to grow 50% a year the next five years. That’s incredible growth. And shows us just how strong the AI trend is.

But TSM also told us there was a slowdown in demand in other sectors of the economy. Smartphone growth remains sluggish. The reality is that consumers aren’t upgrading their smartphones as often as they used to.

Data from Counterpoint Research shows U.S. consumer demand for smartphones fell 10% this January. And that collaborates with Apple’s purchases of semiconductor components. Its early purchase orders this year imply that iPhone shipments will drop 10-15% on the year.

Automotive semiconductors are also down (which is a large part of the reason Tesla (TSLA) stock is down lately). Electric vehicle growth has slowed down markedly, and the general automotive sector is suffering due to the high interest rate, making car loan payments out of reach for many.

In addition, governmental incentives to purchase EVs are declining. Germany abruptly stopped its EV tax credit and France and Norway are about to follow. Then in the U.S., fewer cars qualify for the $7,500 tax credit.

All of this leads to only a forecasted growth of 4% this year, which is down from double digit growth in previous years.

Even the traditional server market is slowing, as hyperscale data centers shift to focus on scaling for AI, rather than general purpose computing and storage.

AI semiconductors are the reason TSM met its guidance targets for the quarter. But one thing is clear — after the runup in prices the past five months, just meeting expectations is not enough to keep the market moving higher.

The underlying problem with TSM’s earnings release, in my opinion, is the capital expenditure number. TSM just maintained their capex spend of about $30 billion this year.

Don’t get me wrong, that’s a huge number. But Wall Street wanted to see an increase in capex. An increase would lead to a greater chance of higher-than-expected sales in the future.

By just maintaining capex, TSM is signaling it’ll only meet expectations going forward.

The AI trend is still young. And the world has an insatiable appetite for the semiconductors to run large language models (LLMs) and other AI applications.

Both ASML and TSM said as much in their earnings calls. AI is keeping their growth intact, even as other parts of the semiconductor industry weaken.

But just meeting expectations is no longer enough. Investors expected to see continued massive beats and higher guidance in this AI-related frenzy. Without that, the market will struggle to go higher. This is something to keep in mind as earnings season heats up.

I expect to see more market volatility in the coming weeks. And likely a further pullback. I’m using last summer as my guide — the last time these companies disappointed investors. That would imply another drop in prices.

After such a heated run-up, and inflated valuations in large AI-related tech stocks, this is a much-expected breather.

It is important to say that nothing has changed about the overall trend in artificial intelligence though, we’re still at the early stages of a massive bull market that will transform the economy and the workplace.

But for now, be careful out there, honor your stops, and prepare a list of companies to buy on a pullback.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.