I’m happy to say that I’m back at it.

I’ve returned from a couple weeks of heavy travel. I hope that subscribers enjoyed the additional insights from my team members Nick Rokke and Joe Withrow over the last couple of weeks.

I never want to sacrifice quality just to meet a publishing schedule, which is why I asked them to contribute to Outer Limits. A big thank you to Joe and Nick for their contributions, which I enjoyed. I hope you did, too.

I did make sure to block off time to still write my Friday Ask Me Anything issues the last two weeks. We definitely covered some interesting topics, some of which you can find here...

While I might not be able to write extensively every day due to travel, I never stop researching and connecting the dots.

And last week was no exception.

There were so many events that took place these last couple of weeks — all worthy of analysis — that included both technological advancements, geopolitical events, and even monetary/fiscal policy. Just have a look at what is happening with the Japanese Yen right now… (Spoiler: It has hit multi-decade lows against the dollar and is giving the U.S. a glimpse of its future if it doesn’t reverse course with its fiscal policy.)

We’ll of course explore the most interesting developments in the coming days.

For today, I’d like to dig into the latest events surrounding Tesla’s first quarter 2024 earnings, which were announced on April 23rd.

The results and coverage of the event are interesting to me, as they highlight both media bias, as well as a fundamental misunderstanding of Tesla as a company and what it is developing in its pipeline.

Tesla had a tough first quarter this year. And the press lambasted Musk for it.

Tesla delivered 386,810 vehicles in the quarter, whereas analysts had predicted 443,000.

One analyst referred to it as an “unmitigated disaster.”

What was mostly lacking was the context:

There were clearly quite a few factors that contributed to a year-over-year decline of its profit by 55% to $1.1 billion.

The cries about Musk’s poor strategy and suggestions that it was losing ground were audible. It seems any chance that they get, they’ll attack him.

And yet, some of the most significant technological developments are underway at Tesla that will transform the company, and also the world as we know it.

Surprisingly, that’s not what the financial media wanted to talk about.

Tesla is a remarkably profitable business.

It throws off healthy free cash flow, which is what has enabled Musk and his team to continue to invest in improved manufacturing technology, battery technology, and most important: breakthroughs in artificial intelligence (AI).

Despite the challenges listed above, Tesla still maintained a 51.3% market share in the U.S. for EVs in the first quarter, on par with the fourth quarter of 2023, and above the third quarter of 2023, which was around 50%.

But the company’s developments in software is what we want to pay close attention to.

It’s latest version of full self-driving (FSD) software is nothing short of phenomenal. The developments of the last couple of months have been an incredible indication of how close Tesla is to Level 5, fully autonomous driving.

As I’ve written before, I got a Tesla with FSD just so I could test and track the progress being made. It’s no surprise that analysts that don’t experience and research the technology first hand don’t understand the rate of improvements, or a flawless point-to-point “drive” with FSD. They just don’t get it. Nothing is better than boots on the ground research.

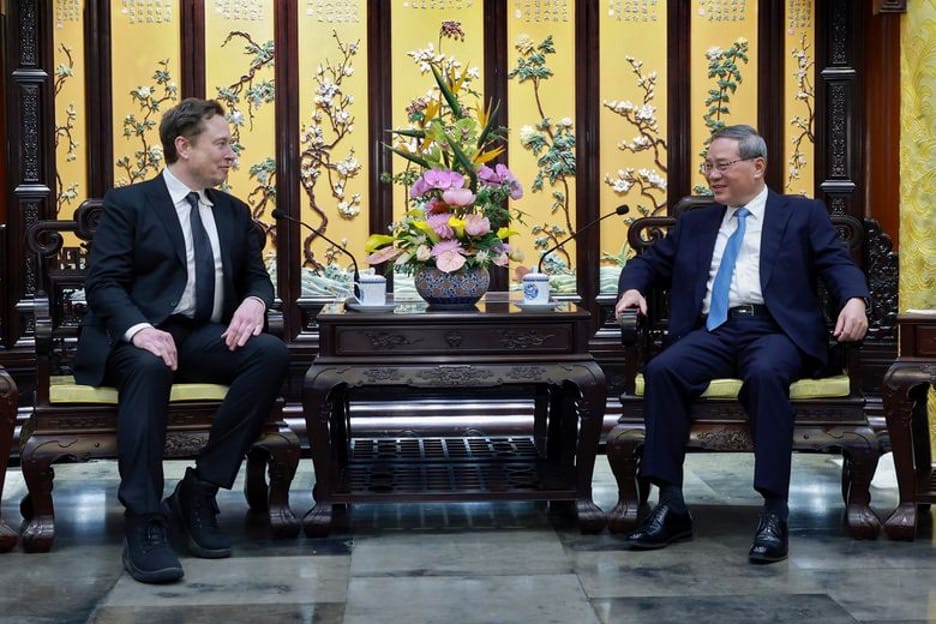

It was no coincidence that Musk flew to Beijing late last week to meet directly with Chinese Premier Li Qiang about Tesla.

The purpose of the visit though wasn’t about Tesla’s factory in Shanghai, or about Tesla’s access to China’s market.

It was about Tesla’s full self-driving software.

Musk was there to get approval to deploy its FSD software on Tesla’s operating in mainland China. In preparation for the visit, Tesla had already struck a deal with Baidu — China’s equivalent of Google — for mapping and navigation data.

The trip was a huge victory.

Musk was able to gain tentative approval to launch FSD in China. To state the obvious, Musk wouldn’t have made the trip if he and his team weren’t confident that the software was ready to deploy at scale.

Tesla is clearly getting ready for launching FSD, and not just in the U.S.

As we learned recently, it has already scheduled a Tesla event to reveal its plans for a robotaxi network on August 8th.

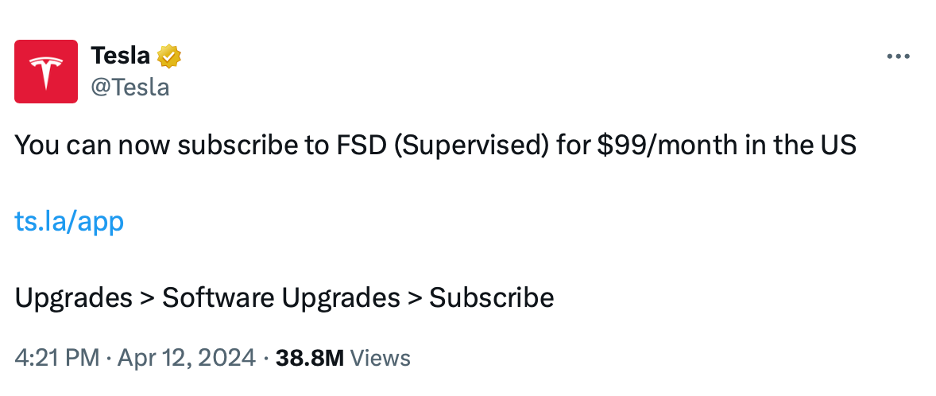

And the price cut to $8,000 for FSD (for a one-time payment) was implemented with an alternative monthly subscription cost of just $99 — cut in half from $199.

Critics are saying that Musk’s “forced” price cuts on its cars and self-driving software will destroy the company. It’s painted as a dire attempt to attract business to a flailing company basically on life support.

And yet, Tesla already has $3.5 billion in deferred revenue from FSD sales as of the first quarter this year, and still maintains 18.5% gross margins despite the headwinds mentioned above.

It would be impossible to find another car manufacturer that has those kinds of software revenues, EV or otherwise.

And that’s precisely the point in understanding Tesla — a point I’ve made for many years now. Tesla isn’t a traditional automotive manufacturing company. It is one of the most successful AI companies in the world.

Tesla isn’t gasping for air with forced price cuts. It’s aggressively innovating and managing costs on its EVs so that it can reduce pricing and “push” its “hardware” (the cars) into the market at more attractive price points to the greater population.

As its “network” of hardware (EVs) continue to proliferate, it has a platform upon which it can deploy one of the most advanced AIs the world has ever seen — FSD.

Not just in the U.S., not just in China, and actually not just on Teslas. That’s right. Tesla is nearing a deal with at least one other car manufacturer to license FSD, enabling autonomy on another manufacturer’s EVs. A deal is expected before the end of this year.

I hope we can all see where this is leading.

Tesla built its FSD AI for the simplest common denominator — vision.

The FSD AI has the ability to infer the right course of actions just by “seeing” what a human sees.

It can ingest the real-time video from all cameras in a split second and decide how to navigate just about any scenario.

This enables lower cost manufacturing because there is no need for expensive LIDAR components or other unnecessary sensors. And it’s also a simpler integration with any EV.

In other words, as long as a car is designed with cameras providing 360-degree vision, a computing platform for FSD could be installed and voila! We have a self-driving car.

The potential here is obvious.

Tesla isn’t just positioning to become the first robotaxi network. Or to enable Tesla owners to opt-in their cars to a ride-hailing network.

It’s in a position to become a standard — maybe even the standard— for self-driving operating systems in the automotive industry.

But why stop at automobiles?

As I’ve written about before, Tesla’s latest progress with FSD is directly related to its humanoid robot project, Optimus.

After all, what’s a self-driving car other than an autonomous robot on wheels?

And the most overlooked “hint” in all this was an offhanded comment Musk made recently…

He said that Tesla will spend about $10 billion this year on AI training and inference.

As a reminder, OpenAI — the company behind the popular generative AI tool ChatGPT — has raised about $13 billion focused on large language models (LLMs).

Tesla is going to spent $10 billion just this year.

My point is that it doesn’t matter if Tesla has a tough quarter. It doesn’t matter if it had job cuts to realign costs. It doesn’t even matter if EV growth slows down or there are delays in production.

This isn’t about car manufacturing. It’s about artificial intelligence.

It’s about becoming a dominant operating system for autonomy.

It won’t matter if the robot has wheels, two legs, six legs, is stationary, in a factory, or acting as a healthcare worker in a retirement home.

Musk and his team at Tesla are swinging for the fences on autonomy. And by the end of this year, the world will figure out what they’ve done.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.