Israeli forces had to scramble.

They just saw 300 blips on their radar. 300 Iranian drones and missiles were airborne and headed their way.

The Israeli forces needed to do everything to prevent these projectiles from hitting their target. They even enlisted the help of allies and an American warship to shoot some down.

This escalation in the Israeli War was what many feared.

Iran, has the biggest military in the Middle East. Israel and Turkey both spend more on their military, but Iran can mobilize over 1 million soldiers. That is if you include reservists and paramilitary groups like Basij.

So far, cooler heads have prevailed. Israel’s retaliations have been limited. And the United States has expressed hesitation getting involved in offensive strikes.

At the beginning of the year, Jeff called out the risk that the Israel/Hamas conflict would expand into a much broader war in the Middle East in Outer Limits — 2024 Will Be Chaos — Here’s How We’ll Come Out Ahead.

I know Jeff doesn’t like to be right about predictions like this. But we analyze them and write about them, because they have economic impact and therefore investment implications.

Most notable right now are those happening around the price and availability of one of the world’s most precious resources…

Oil.

Right now, the oil industry is experiencing the largest inventory drawdown in history,

27% of the world’s oil comes from the Middle East. And any disruption to the flow of the dinosaur juice will send prices higher.

So far in 2024, the price of crude oil has risen 19.5%. And an escalation of this conflict will send prices higher.

But the impact of war on oil prices is likely a short-term event. Every war since WWII had only minor market disruptions.

And there is a reason we see oil going higher — much higher — in the coming years.

Before I go any further, I’d like to introduce myself. I’m Nick Rokke. Some long-time subscribers of Jeff’s work may recognize me from the Brownstone Research days. I was the senior analyst of Jeff’s flagship, large-cap tech stocks advisory service, The Near Future Report.

When I heard Jeff had a heavy travel schedule, I jumped at the chance to share some of my research with readers, both old and new. I’m excited to be back. And you’ll be hearing more from me in the coming months.

One of the biggest keys to our market beating returns in The Near Future Report was marrying the three pillars of investment analysis: The macroeconomic climate, company fundamentals, and the technicals. We can think of this as the what, who, and when of investing.

When the macro climate changed in 2022, it was clear tech stocks were out of favor. So we shifted the “what” we would invest in. And we dug deep in the commodity sector to find the best companies (the “who”) with the most potential for higher stock prices.

Then we waited for the right time to purchase by watching the market technicals (the “when”).

We’ve followed the developments in the oil industry for a couple of years now. Those who were with us in 2022 or 2023 may remember we recommended oil services company, Halliburton (HAL) in August 2022 and oil refiner Phillips 66 (PSX) in February 2023. Since those recommendations, these companies have gained 39% and 61%, respectively.

And we think our thesis for investing in these companies is just as strong now as it was then.

That’s because there’s a structural reason oil is going higher in the coming years.

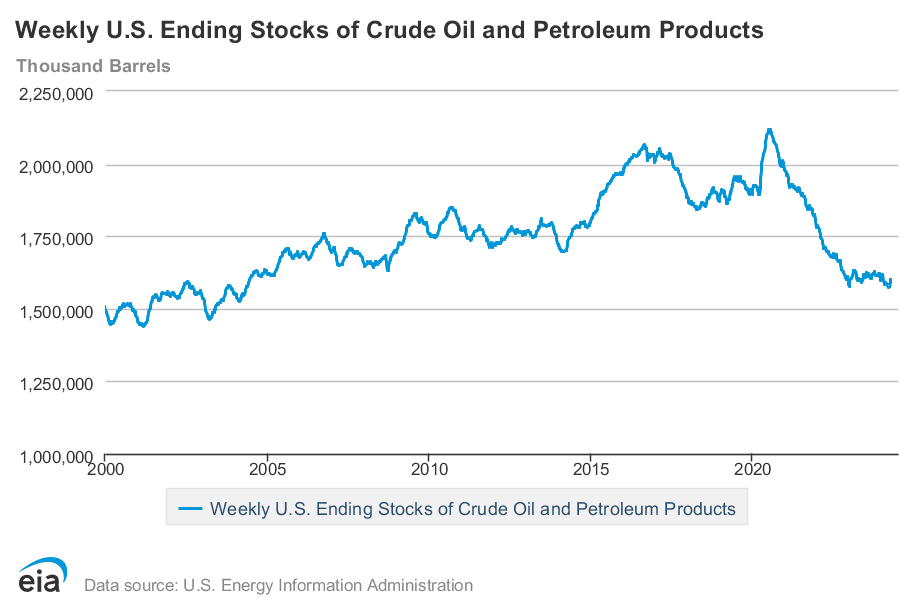

Over the past few years, we’ve witnessed a major drawdown of the U.S. crude oil stock.

In the chart below, we can see this drawdown began towards the end of 2020 and accelerated through 2022.

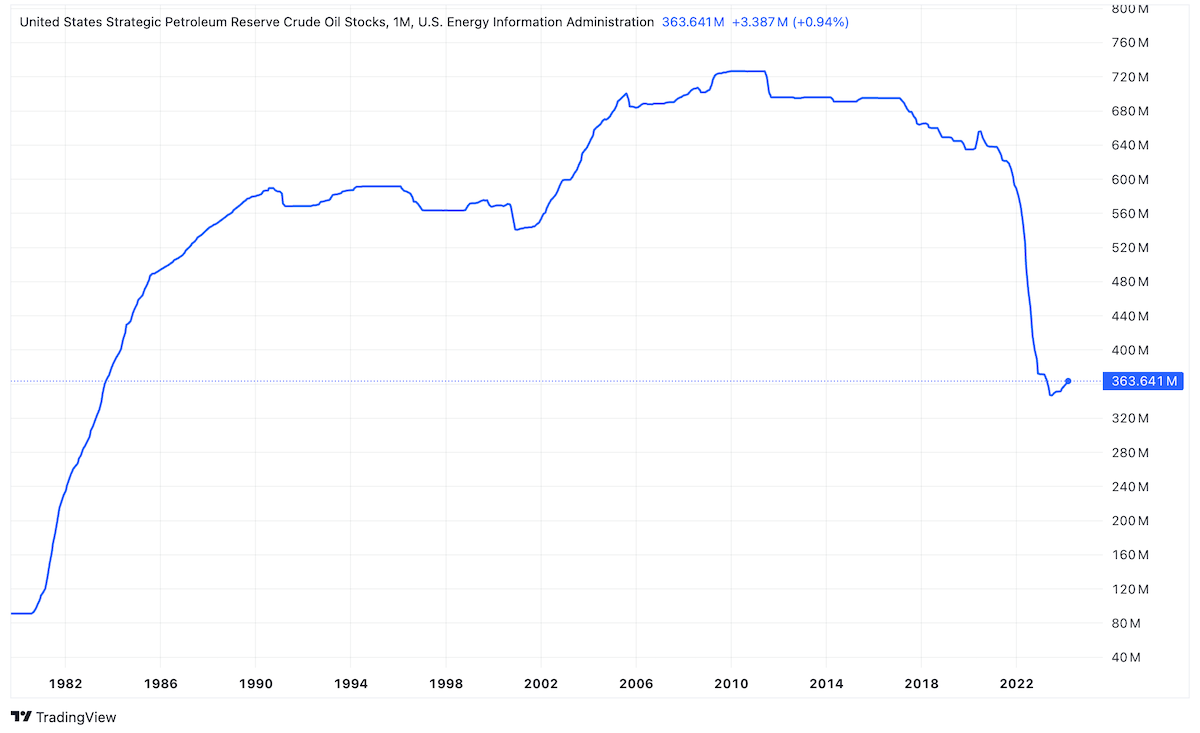

It’s worth noting that this number also includes the U.S. strategic petroleum reserve (SPR). And the SPR has also been drawn down to its lowest level in decades for political purposes.

That chart looks like this:

We now have only 17 days of oil inventory left in the U.S. SPR.

And in all practicality, it’s even less than that.

The U.S. government stores the oil in underground salt caverns in Texas and Louisana. And a good portion of the oil left has accumulated gases like hydrogen sulfide over time and degraded the quality of the oil.

Now that the SPR has been drained in an effort to get gas prices down (which hasn’t worked, I might add), it won’t be able to cushion the blow of any supply disruptions.

If there is a larger disruption, the world will have three choices — only 1 is practical.

We’ve known this to be the reality for years.

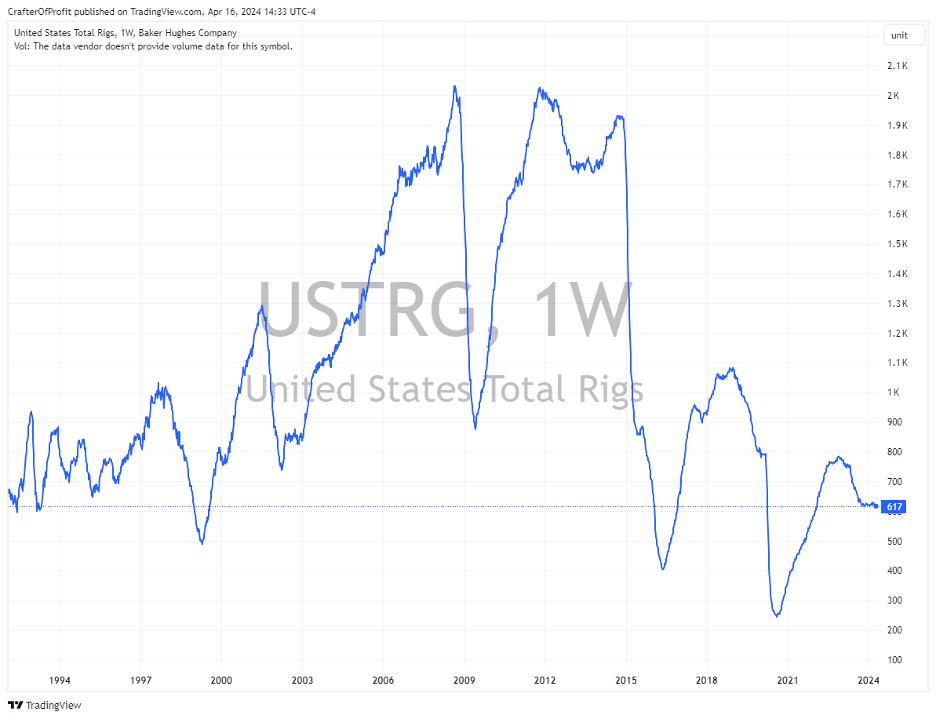

And yet, we have not seen an increase in drilling in the U.S.

The easiest way to show drilling activity is to look at the Baker Hughes Active Total Rigs Index. The more rigs active, the more drilling activity taking place.

As we can see, the number of active wells is about one-third of what they were at the peak in 2011. And we are operating nearly half as many as we were pre-pandemic.

Oil companies have been hesitant to spend the money needed to replace existing wells, due to the shift towards electric vehicles and political opposition against oil and natural gas exploration.

In 2022, oil companies spent $106.6 billion in capex to expand drilling.

That sounds like a large number, but it’s not enough. The Energy Information Administration (EIA) noted that to maintain our production numbers, U.S. companies likely need to reach the capex levels we saw in 2010-2014 before the downturn started. Those years saw an average capex spend of $200 billion. That means 2022 capex spend is about half of where it needs to be.

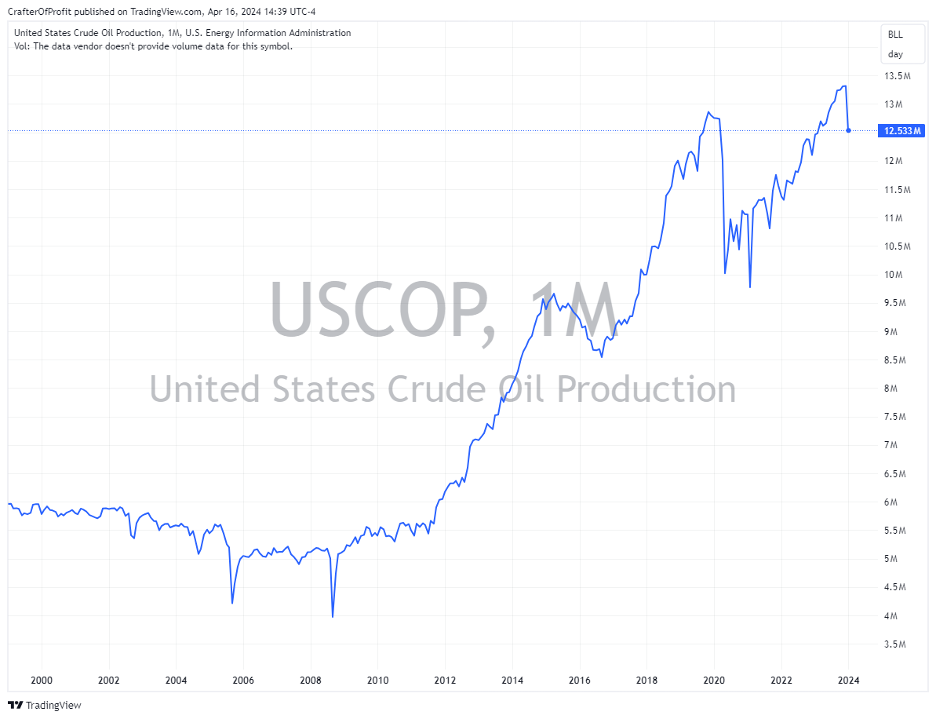

This problem is exacerbated by the fact that most of the drilling now takes place in the shale fields in the Midwest.

And shale oil fields deplete much faster than traditional oil wells. Traditional oil wells have production deplete 5-10% a year.

But fracking wells, which make up over half the new wells drilled in the U.S., deplete much faster. Fracking well production falls 50% after the first year and then 30% the year after.

This means if a well initially produced 1,000 barrels of oil a day, the next year it would produce 500 barrels a day. The year after 350 barrels a day.

To keep our oil production up, we need to drill more wells. But we clearly are not. And this is beginning to show up in U.S. oil production numbers. After peaking at around 13.3 million barrels per day (mmbpd) in November 2023, production has plummeted to 12.5 mmbpd.

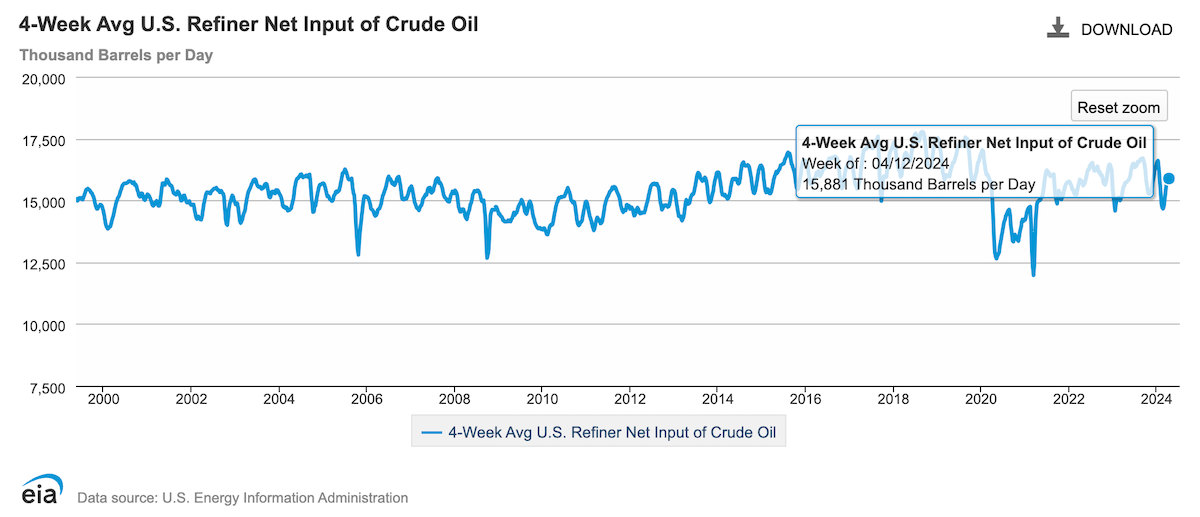

And our consumption of oil is not declining by that much. The only exception was the depth of the pandemic, which was an economic disaster.

Below, we can see that demand for oil by refiners is on a slight uptick into the summer driving season.

U.S. refineries demand about 3 mmbpd more than the U.S. produces. The U.S. oil refiners are still reliant on oil imports. With production declining and demand increasing, we are likely to see higher prices.

I’m confident that oil producers will go higher in the coming years. Oil fundamentals point to higher prices in the future.

Jeff predicted $200 oil would happen at some point back in 2022. It hasn’t happened yet, but I’m confident he will be proven right.

But the problem with making a new investment right now is that oil stocks just had a monster run-up. Since bottoming on January 18 of this year, the SPDR Energy Select Sector ETF (XLE) rose 20% to its peak last week. And right now we’re seeing a quick and sudden price reversal.

This reversal looks like it has further to go. I could easily see another 5-10% pullback in the energy sector.

While I’m excited for the prospects of the price of oil and for oil companies, a patient investor is likely to see lower prices in the short-term.

And the longer that the conflict doesn’t escalate, the lower the price of oil will go and the lower these energy producers will go.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.