Are we on the cusp of the next Great Biotech Bull Run?

As we recapped in yesterday’s issue of Outer Limits, we endured a brutal Biotech Winter from 2021-2023. And now, that winter is showing signs of thaw.

Today, we’ll begin to look at the big question surrounding biotech.

After three years of failed pandemic policies, setbacks, and underperformance, is it finally time to get bullish on biotech once again?

And if so, what should we as investors do about it?

Before we answer that question, we must understand the most important factor impacting the biotechnology sector as a whole in the current climate.

When it comes to biotech stock prices, this one factor has the power to create a major tailwind — or headwind — for the entire sector, regardless of what’s happening with each individual company.

I’m referring to the Federal Funds Rate. We can call it the Fed Funds Rate for short.

The Fed Funds Rate is the rate at which banks lend money to one another. As such, it strongly influences short-term interest rates across the economy.

When we hear about the Federal Reserve (the Fed) raising or cutting rates — it’s referring to the Fed Funds Rate. That’s the rate the Fed controls.

It’s not a novel observation that interest rates impact the stock market. All else equal, lower rates tend to push investment capital into stocks. That’s largely because investors cannot generate a strong return in fixed-income assets like bonds when rates are low.

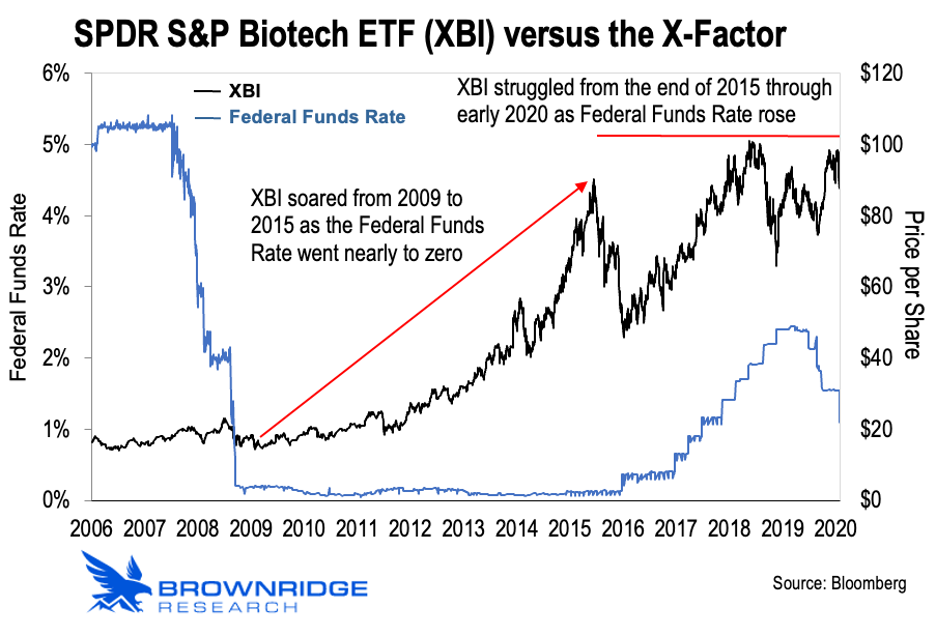

This relationship is particularly pronounced with biotechnology. We can see it clearly in this chart:

The black line here is the SPDR S&P Biotech ETF (XBI). The blue line is the Federal Funds Rate. That’s our X-factor. I doubt that comes as a surprise to anybody.

XBI is a great gauge of the overall biotech market because it’s an equal-weight ETF. That means the fund invests equally in every biotech stock it holds. It doesn’t concentrate its holdings in larger companies as some ETFs do.

This approach provides a more balanced view on the biotech sector. And if we look at the chart above — the correlation between biotech and interest rates is clear.

XBI began a massive run in 2009 as the Fed Funds Rate quickly fell to nearly zero. The biotech ETF surged 500% higher over the next six years, as rates remained at depressed levels.

Investment capital was cheap, which fueled investment into higher risk, higher potential return investments like those in the biotech industry. It was great for innovation, and biotech investors made a killing.

But XBI began to pullback in the third quarter of 2015. By the following March, it had given up roughly half its gains.

This pullback corresponded with the Fed beginning to modestly hike the Fed Funds Rate that year. It was the first time in nearly a decade that rates were once again on the rise.

And we can see that XBI remained volatile from that point forward through March of 2020. The above chart cuts off there so as to not include data from the COVID hysteria — which distorted everything. We talked about that in depth yesterday.

But the correlation is clear.

Biotech performs exceptionally well when interest rates are falling. A falling Fed Funds Rate serves as a major tailwind.

Of course, the reverse is true also. Rising interest rates create headwinds for the biotech sector. That’s especially true for early stage biotech.

We should note the pattern in the chart above, though. Biotech stocks sold off sharply when the Fed Funds Rate began to rise. But then they bottomed and pushed higher once again — even as the Fed Funds Rate continued to rise.

This speaks to a nuance we should understand. It’s all about market sentiment and expectations.

In the example above, XBI sold off as soon as the market came to anticipate higher interest rates. Then it bottomed and began to march higher again after the market had recalibrated itself to a climate where the Fed Funds Rate wasn’t zero. This dynamic will be insightful for us going forward.

Getting back to our question — is the next biotech boom upon us right now?

To answer this, we need to determine what’s likely to happen with interest rates. And we need to compare the results of our analysis to market expectations.

Starting in January 2022, the Fed began unprecedented rate hiking. At the time, the Fed Funds Rate was 0.08%. Zero, in other words.

But by the start of February 2023, the Fed’s key rate had jumped to 4.6%. In percentage increase terms, this was the fastest and most aggressive rate-hiking cycle in the Fed’s century-plus history.

It’s important to be clear that the Fed does not set rates for the entire economy. But short-term interest rates do “feed” off the Fed Funds Rate.

Long-term rates tend to adjust in a similar way. We see that with 30-year mortgage rates rising to nearly 8%. The Fed didn’t raise mortgage rates directly. But those rates did increase along with the Fed’s rate hikes.

As we discussed earlier, interest rates impact the stock market. That’s because future returns for equities are compared to the “risk-free” rate of return. In the world of finance, that means U.S. Treasury bonds.

A 10-year Treasury bond yielding close to 0.5%, like we saw in 2020, makes stocks a more attractive option for investors. Why tie up capital for a measly half a percent return?

Fast forward to today, and investors can earn 5.4% on 3-month Treasury bills. And the 10-year Treasury now yields 4.6%.

We’re in an entirely different climate here. And it means the discounted cash flow for stocks gets “marked down.”

Put simply, stocks have to compete with bonds and other asset classes for investment capital. And through all of 2022, they lost that competition. The S&P 500 ended that year down some 20%. The peak-to-trough loss was 24%.

Sentiment changed in August of 2023. That’s when the Fed stopped raising rates.

Then in October 2023, Fed Chairman Jerome Powell suggested that the Fed was likely done with rate hikes. Note that he never said the Fed was ready to start cutting rates. He simply stated that the Fed planned to hold firm and monitor the data going forward.

The market read into Powell’s announcement what it wanted to. Sentiment shifted on a dime as investors came to believe that rate cuts were imminent.

This expectation of the Fed’s reversal on interest rate hikes is now known as the “Fed Pivot”… and the market has been especially fixated on it since last October.

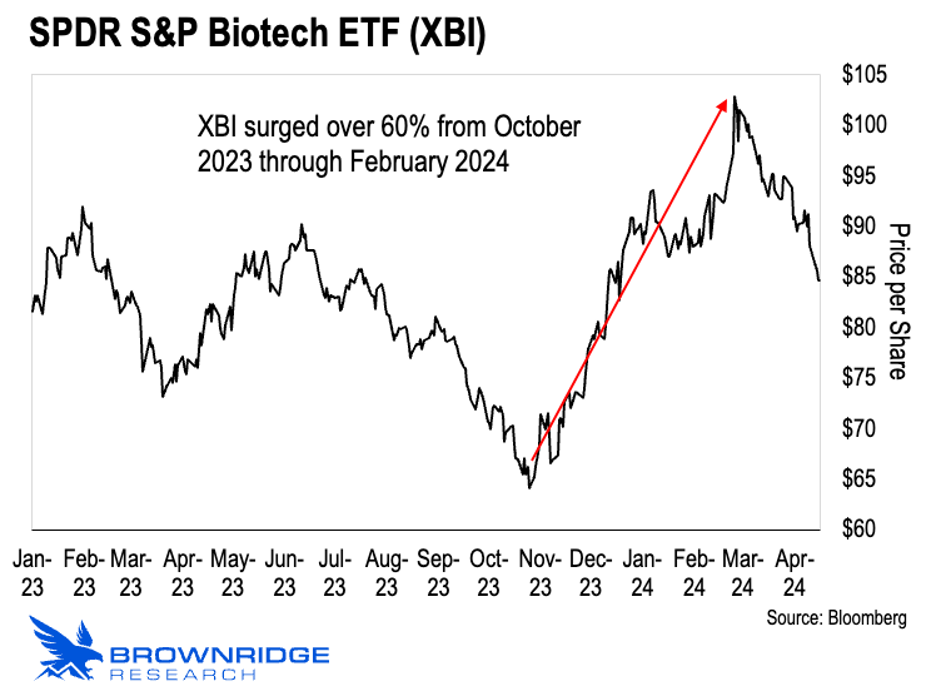

In other words, investors convinced themselves that the Fed Pivot was near. And that’s what drove the recent boom we’ve seen in biotech. This chart shows it clearly:

Using the SPDR S&P Biotech ETF (XBI) as our proxy once again, we can see that biotech took off since last October through the end of February 2024. XBI was up over 60% at the peak.

I’m confident in stating that this move was driven largely by the market’s belief that the Fed was about to cut rates. Now, reality has set in.

Above, I said that the biotech industry is particularly susceptible to interest rate moves. That’s especially true of the early stage companies like those we targeted in Early Stage Trader.

It’s all because early stage biotech companies are what we call pre-product revenue companies. They don’t have any products to sell until they advance their lead therapies through the Food and Drug Administration’s (FDA’s) clinical trial process.

The clinical trials are designed to demonstrate that a given therapy is both safe and effective… which means they must be extensive and rigorous (with the exception of COVID-19 “vaccines,” of course).

As such, it typically takes a therapy 6-12 years to get through clinical trials. Then it can take another 8-12 months to get through the regulatory review process for approval.

That means an exciting biotech startup isn’t likely to have any meaningful revenue for at least seven years… and maybe a fair amount longer.

At the same time, it costs biotech companies hundreds of millions of dollars to advance a therapy all the way through the clinical trial process. In some cases, it can even cost over $1 billion. That’s money each company must raise from external investors.

The only reason biotech companies go through with such a process is because the rewards can be enormous.

Lipitor, which treats high cholesterol, has lifetime sales over $150 billion. Humira has generated lifetime sales of $109 billion.

It’s a high-risk, high-reward business. Spend as much as a $1 billion over a decade to potentially make tens of billions (or more) in the years ahead.

But this is why the industry is sensitive to interest rate moves. When rates rise, it tends to put downward pressure on biotech valuations. It also makes it harder for biotech companies to secure the financing they need.

And this is why we need to have a clear read on interest rates to determine whether now is the time to buy biotech stocks again.

And that’s right where we’ll pick up tomorrow…

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.