Mary Dixon tried everything.

Weight Watchers? Jenny Craig?

Nothing worked for her. No matter what program she tried, Mary couldn’t manage her weight.

It’s a common problem today. The Centers for Disease Control and Prevention (CDC) reports that approximately 42% of Americans were considered obese as of 2017. That figure was just 30% in 2000.

Mary talked to her doctor, and he prescribed a new medication to treat her pre-diabetic condition.

She quickly found out that the medication had the curious — and welcome — side effect of suppressing her appetite. And that led to weight loss. Mary lost 14 pounds in six weeks.

The novel medicine Mary took is called Ozempic.

I suspect readers have heard of Ozempic and similar medications like Wegovy. These semaglutide drugs were originally designed to treat diabetes. And they have been hailed as something of a miracle by those struggling to lose weight.

There’s even talk of an “Ozempic Economy,” as other businesses like grocery stores and restaurants adjust to a new, less-hungry group of customers.

But what few patients think about is the impact of the “Ozempic craze” on Novo Nordisk (NVO).

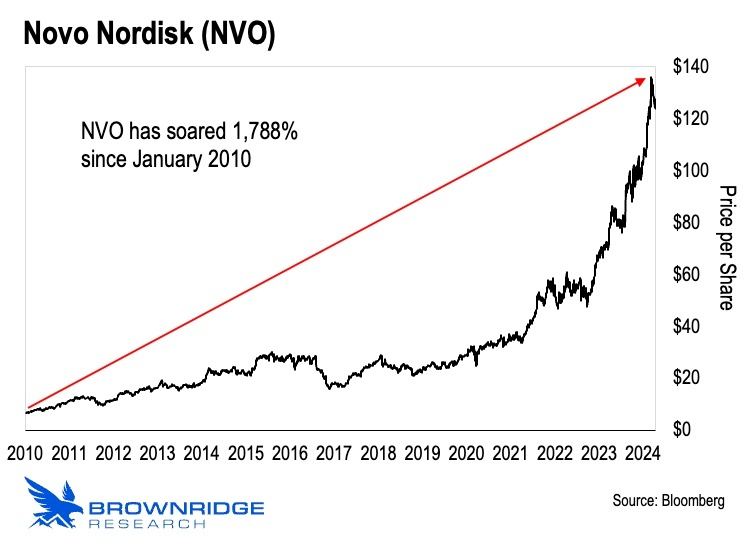

Novo Nordisk is the biotech company that developed Ozempic. Its stock is up nearly 1,800% since the start of 2010. And that includes a 250% spike just in the last three years.

Every $5,000 invested in NVO in January 2010 would be worth over $94,000 today.

What a great illustration of the power of world-changing biotech companies.

Of course, not every biotech company has a record like Novo Nordisk…

Those of us who invested in biotech in the last 4 years have also experienced the harsher side of biotech. We know there are many of you reading this today. We’ll get back to that in a moment.

After a brutal Biotech Winter, the sector as a whole has put up some eye-catching numbers recently…

The U.S. stock market bottomed in late October of last year. Since then, the Nasdaq is up 22%. The S&P 500 is up 21%. Even the old Dow Jones Industrial Average has risen 17% over the last six months.

And one corner of the market has been handily beating the broader averages over the past six months. That’s biotechnology.

If we look at the SPDR S&P Biotech ETF (XBI) — it’s up 29% since last October. And that’s after languishing for years.

XBI is a great gauge of the overall biotech market because it’s an equal-weight ETF.

That means the ETF invests equally in every biotech stock it holds. It doesn’t concentrate its holdings in larger companies as some ETFs do. This approach provides a more balanced view on the biotech sector.

Given biotech’s recent outperformance, it’s been no surprise to us to receive many notes from readers like the one below:

“Biotech has been in bear market for more than 3 years. Lot of the investments are down more than 95%. I don't want to miss the biotech comeback whenever that happens. Can we expect a biotech-focused portfolio in the near future?”

Is the next biotech boom upon us? And is it time to back up the truck?

Before we dive in, I’d like to introduce — or perhaps reintroduce — myself to the Outer Limits audience.

My name is Joe Withrow. I’ve worked with Jeff behind the scenes since nearly the beginning.

Our time together goes back to the old Bonner & Partners days — for readers who remember those. And I helped Jeff build up Brownstone Research as a world-class financial research powerhouse under our mutual employer at the time, Legacy Research. Over 3 million people subscribed to our work back then.

So I was beyond thrilled when Jeff asked me to come talk biotech with you this week. It’s an honor and a privilege to be featured in Outer Limits. I drop everything I’m doing to read each issue when it comes out every afternoon.

We’ll have a few days together this week, as Jeff is traveling. I want our time together to be productive and valuable for readers.

We're going to be analyzing the dynamics of the biotech industry as they currently exist...

Starting with today: We’ll do a postmortem of sorts on our original biotech portfolio, which we launched under our previous employer. Brownstone Research subscribers will recognize it as Early Stage Trader.

Then tomorrow, we’ll assess the biotechnology industry within the context of the macroeconomic climate we find ourselves in today. And we’ll use that assessment to answer the timing question.

Let’s start our discussion with a brief review of the beginning.

As longtime readers may remember, I worked closely with Jeff to develop our original biotech research service, Early Stage Trader.

The story of Early Stage Trader is an interesting one. And not many have ever heard it with full context.

We were deeply plugged into the biotechnology space at the time. Jeff was the very first analyst to cover the CRISPR genetic editing revolution all the way back in 2015.

At the time, he was writing to his subscribers about how CRISPR would be our greatest tool in the fight against disease. This was before any CRISPR companies even went public.

And he was the first in the industry to recommend the three first-generation CRISPR stocks: Intellia Therapeutics (NTLA), CRISPR Therapeutics (CRSP), and Editas Medicine (EDIT). That was in our small-cap tech research service, Exponential Tech Investor.

Jeff first recommended NTLA in May 2016. We closed the position in December 2020 for a gain of nearly 309%.

He recommended CRSP in October 2016 and then sold it in December of 2019. We booked a 332% return on that one.

As for EDIT, Jeff recommended it all the way back in February 2016. We never exited the position simply because we knew that it would win the patent battle against CRISPR Therapeutics and Intellia.

As such, Editas’ intellectual property (IP) is worth many multiples of what the stock currently trades. (Jeff has written quite a bit about EDIT in Outer Limits. This issue is a great starting point, with links at the bottom for further reading.)

The feedback from readers after booking those big wins with NTLA and CRSP was phenomenal. And it was the spark we needed to launch Early Stage Trader.

After years of deep research, we developed a proprietary system for analyzing the entire universe of early stage biotech companies while they were still private.

Our system catalogued a wide range of data points for each company and fed it into a massive database.

At any point in time, using our database, we could get a feel for what was happening behind closed doors in the private biotech space.

We knew which areas of therapeutic development were getting the most funding. We could see how much private capital was flowing to these companies and their developments. And this gave us a lens on what the biotech-focused venture capital (VC) firms were most excited about.

It took us over a year to build the system and a lot of money. But when it was complete, we had — what we believed — was the most valuable biotech dataset in the investment research industry. We knew of nothing else like it.

And we didn’t stop there.

We developed a suite of analytical tools for spotting post-IPO trading trends for these companies. Our mission was to identify clear signals to help us trade the early stage biotech market, well before Wall Street had ever heard of any of these companies.

We back-tested our system on every VC-backed biotech company that had formed over the past decade. There were 1,348 of them.

Our analysis provided us with very clear signals, from which we developed our proprietary trading system.

We designed the system to home in on biotech stocks that would produce outsized gains within roughly 6-12 months of their buy signals.

And it worked perfectly.

Subscribers who were with us back then will remember what happened next.

We launched the Early Stage Trader service in July of 2019. Less than five months later, we booked our first trade for a 432% gain. We followed that by booking gains of 87%, 116%, and 107%.

Our first four closed positions delivered an average return of nearly 186% in the first 4-5 months of the service. And the majority of our open positions showed strong gains, as well.

It was so rewarding to see our hard work result in great returns for readers. The strategy we built was working.

Then came the COVID-19 hysteria.

One might think that a global pandemic would be a boon for biotech.

And for a few biotech companies, it was.

Those few companies were tapped to produce the government-mandated COVID-19 “vaccines,” and they made a fortune.

These companies directly benefitted from expedited timelines, loose and limited testing, and approval processes, not to mention the free mass marketing — sponsored by the U.S. government. Oh, and they received full legal immunity from any damage their new products might cause. Nothing like this had ever been done before, with so little concern for safety and patient outcomes.

But for the rest of the industry, the global COVID-19 pandemic was a major disruption. It set biotech research and development back years.

I’m sure we remember the early days. We were led to believe at every turn that COVID was akin to the black plague. The globalist medical cartel’s official models said it would kill hundreds of millions of people.

That is, unless we all bunkered down in our homes, wore surgical masks, sprayed down our packages like they were a crime scene, and remained six feet away from everyone else at all times.

“Two weeks to flatten the curve” became some insidious combination of Orwell’s 1984 and Huxley’s Brave New World…

A totalitarian state uses mass surveillance tools and propaganda to control the population, mixed with a dystopian future where the government keeps the population distracted by pushing mass consumerism and a mind-bending drugs.

For those who have read those works of science fiction, the COVID hysteria sure looked familiar.

We first wrote about COVID-19 on January 27, 2020 — in The Bleeding Edge, our free daily e-letter at the time.

Jeff recounted his experience with the SARS outbreak in Asia back in 2003. And he pointed out that the Wuhan coronavirus looked eerily similar. But he also gave caution...

“Right now, we don’t have all the information to make an informed judgment of this outbreak." — Jeff Brown, The Bleeding Edge, January 27, 2020

By March 15, 2020, U.S. states began implementing lockdowns. And hysteria ensued.

It took us about a month to figure out what was going on.

Better data started to come out in April. We found that COVID-19 was not nearly as deadly as they told us it was. And we took our stance.

In the April 16, 2020 issue of The Bleeding Edge, Jeff wrote:

“… the case fatality rate is likely on par or potentially even lower than seasonal flu.

It is time to thoughtfully begin the process of reopening the U.S. economy. Four weeks ago, we didn’t have the data. Now we do.

We’ve had enough of this fear- and panic-induced crisis based on shaky assumptions. It’s time to get back to school and rebuild the global economy.” — Jeff Brown, The Bleeding Edge, April 16, 2020

As weeks turned into months, better data became available. We tracked it all — and it was painstaking work.

It required tracking down individual scientists and independent researchers. Jeff addressed this in Outer Limits — One of Our Biggest Challenges in 2024…

"The scientific journals would also refuse to publish research that didn’t support the desired narrative. Often times, the only place to find research during the pandemic were out of the way online sites that posted new scientific research.

We couldn’t find the research with a general Google search. The only way was to know the exact title of the research, or to scan the online sites looking for new research, which is exactly what I [Jeff] did. — Jeff Brown, Outer Limits, December 26, 2023

We began to learn that the virus was not particularly dangerous to young, healthy people. Lockdowns were ineffective. Masks did little, if anything.

And Jeff wrote about it all in The Bleeding Edge. In fact, as we moved deeper into pandemic times, we were so confident in our assessment, Jeff launched his American Heartland Tour — to continue his boots-on-the-ground research on 5G, and to show readers that it was okay to be out in the open.

But the Original COVID Agenda lingered so much longer than any of us expected.

Day after day, Jeff and our team shared our conclusions based on the research: The virus was real, but the hysteria was manufactured just like the virus.

None of that is in question now.

Even outlets like New York Magazine — which peddled the COVID hysteria non-stop — published a story late last year admitting that lockdowns were a “failure.”

And Dr. Fauci has gone on record admitting the six-foot rule “sort of just appeared” and lacked solid scientific basis.

Yet, many states aggressively enforced mandated lockdowns for months. And even as late as January 2022, the government was still trying to mandate COVID-19 vaccines. Nearly two full years from the start of the hysteria in the U.S.

The current administration here in the U.S. didn’t officially declare the pandemic over until May 11, 2023 — over three years later.

All that hysteria wrecked most of the biotech industry.

Nearly all clinical trials stopped on a dime. And many remained on pause for nearly a year.

At the time, I was sitting in on all the investor calls for our portfolio companies. For a period of six months or so, it was all about COVID-19. That’s it. Every other promising therapeutical development had completely stopped.

I remember one call in particular…

It was June or July of 2020. That’s when those clinical trials deemed “most essential” got the green light to start back up. That list included a trial being conducted by one of our next-generation oncology companies. Naturally, the company opened the trial back up.

The problem is the patients didn’t come back for treatment or observation. They told the clinicians that they felt it was too risky.

We’re talking about patients with terminal cancer… and they were more scared of COVID-19 than they were of their cancer.

Nearly all clinical trials froze for 6-12 months by mandate. Then many trials took even longer to restart after receiving permission to do so. All because patients were terrified of coming within six feet of another human being.

This dynamic wasn’t just unusual. It was unprecedented.

Clinical trials are the lifeblood for every early stage biotech company. If the trials aren’t moving, the company is in trouble. That’s why the COVID hysteria was so devastating to biotech.

This disruption didn’t set the industry back 6-12 month. That’s how long the trials were frozen. It set the industry back at least two years. Probably three.

It all has to do with trial design.

To be statistically relevant, the data collected from these trials must be “clean.” And that means treatments are administered on a regular schedule. Then follow-up observations are recorded on a regular schedule.

Everything must be consistent. If it’s not, the data is corrupted, and clinicians can’t glean accurate insight from it.

So when the clinical trials stopped, progress went backwards. Many companies had to reset their evaluation schedules.

But at the same time, their expenses didn’t go away. So the industry found itself in a position where it was burning cash without seeing the expected progress.

Who would want to invest under those circumstances?

And so, the biotech winter set in…

The Early Stage Trader portfolio was drenched in red during these months.

Every position was down materially. Even when the overall stock market rebounded — as Jeff predicted it would — early stage biotech didn’t budge. Again, therapeutic development had ground to a halt.

We knew that biotech would take a while to come back. But our publisher at that time wanted us to liquidate the entire Early Stage Trader portfolio and close the service. It wasn’t very “promotable,” they said. We disagreed with that mindset.

We knew that we held some of the most exciting biotech companies out there at the time. If we liquidated our portfolio, we would be dooming our subscribers to terrible realized losses. Our preference was to see subscribers through the Biotech Winter as best we could, because we knew it would pay off.

If it took months, we would work for months. If it took years, we were prepared to do that.

So in every Friday afternoon update, our message was to hold on. I’m sure we sounded like a broken record.

Though we designed Early Stage Trader to capture short-term gains based on trading signals, we still targeted only the highest-quality biotech companies. It would take time to get back to even, but we knew we had some true gems.

And even if there were companies that would struggle to recover from COVID’s destruction, our preference was to navigate a graceful exit. We felt we owed that to readers. There was no sense in dumping everything at the bottom.

It was painful. We looked at the portfolio every day. We saw the red — the paper losses.

I know it was a difficult time for all of us. And we read all your feedback, every day. We took it very seriously.

Needless to say, our former publisher had a different view on what to do with the portfolio. And at a certain point, the matter was taken out of our hands.

As I pen this, the Early Stage Trader portfolio, which was officially closed down at Legacy Research, is down just 7%. (I still continue to track the portfolio.) That’s assuming equal weight positions in every past recommendation. In other words, if investors put the same amount of money into each position on the day of recommendation, they would be down 17% today.

That’s nothing to brag about. But considering every position was down materially at the bottom, it’s not nearly as painful. And it’s a strong testament to everyone who held on through the pain.

And by the way, that current portfolio return is down from the peak. The portfolio was about back to even when Jeff and I sat down to do this postmortem last month.

With the benefit of time, we do feel some vindication that our original plan to hold on was the right one. We wish we could have been there to see readers through it all at our old outfit.

Of course, we can’t change what happened. All we can do is our best to provide guidance for readers going forward.

We’ve limped through some hard months. And we seem to have made it through the deep trench — the great Biotech Winter.

And that brings us to today.

Today, we find ourselves at the cusp of what could turn out to be an incredible biotech rebirth.

In tomorrow’s edition of Outer Limits, we’ll attempt to chart a course for biotech in the months and years ahead.

And we’ll answer that question…

After years of being frozen in the biotech winter, is it finally time?

Is the spring thaw upon us?

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.