Since October 2023, biotech’s recent 60% surge has been fueled by expectations.

As we discussed yesterday, the markets expected the Fed to cut interest rates in March of this year.

That’s what drove biotech’s recent run.

But the Fed didn’t cut rates in March. It didn’t pivot.

And now, biotech stocks have pulled back accordingly.

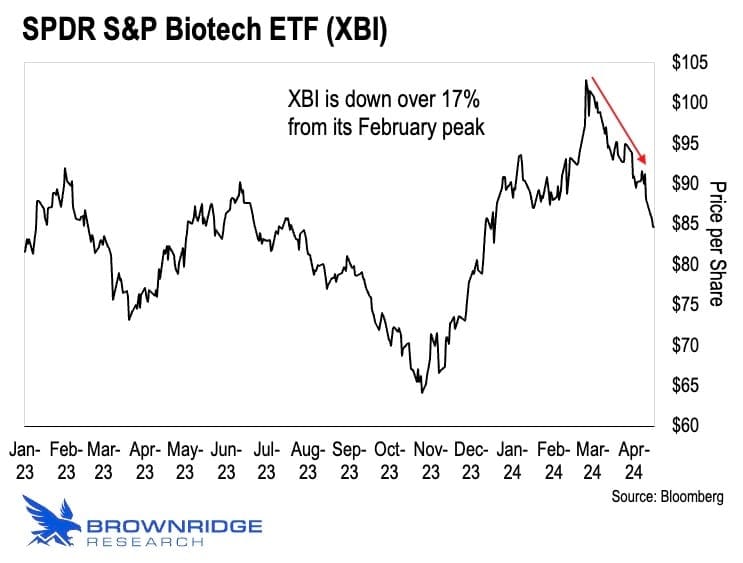

As we can see below, XBI is now down over 17% from its February peak.

What happened?

Why didn’t the Fed cut rates? And why did the market believe so strongly that it would?

More importantly: Where does this leave us today, as we lie in wait in the spring thaw?

In today’s final installment of our State of Biotech series, we’ll state our case… and take our stance.

Why didn’t the Fed cut rates? And why did the market react the way it did?

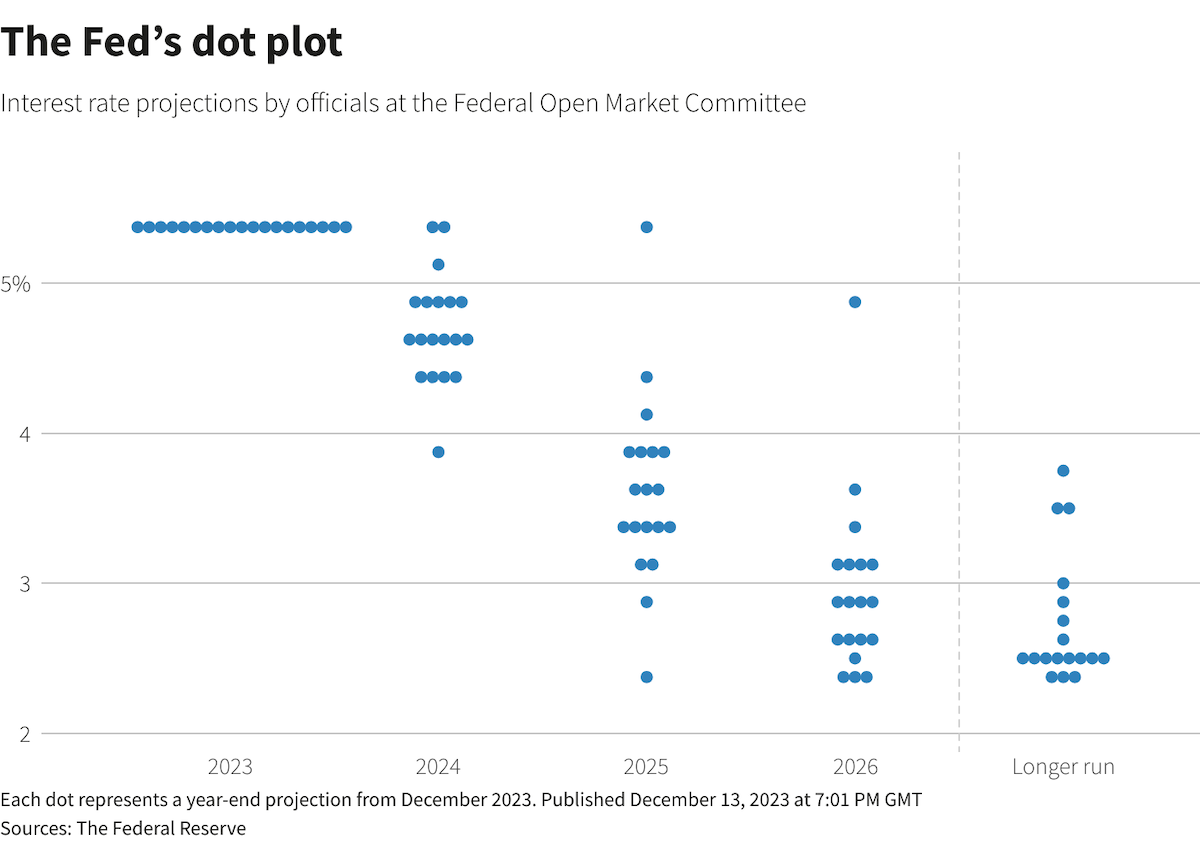

It all comes down to the Fed’s quarterly “dot plot” — the one that came out in December 2023.

This is a chart that summarizes the Federal Open Market Committee’s (FOMC’s) collective expectations for interest rates over time.

The FOMC is composed of 12 members. It includes the Federal Reserve Chair, the Board of Governors, president of the New York Fed, and four of the 12 regional Fed presidents.

The FOMC is the Fed’s inner sanctum. It meets eight times a year to discuss monetary policy. The dot plot is supposed to be representative of these insider discussions.

Last December’s dot plot showed that FOMC members expected three rate cuts this year and four in 2025. And it projected the first rate cut to happen in March 2023.

Here’s what last December’s graph looked like:

Notice how the dots move lower and lower across time in the plot. When a dot moves lower, that’s one FOMC member suggesting that they expect a rate cut to happen.

This is a major reason why the market became fixated on the idea that rate cuts were imminent back in October 2023. Investors took the dot plot at face value. But there’s a nuance here that the market overlooked…

Each dot on the chart represents an individual FOMC member’s projection for the Federal Funds Rate over time, looking forward. That’s all it is.

Each member gets to contribute their own dot… but they are making projections with backwards-looking data. They can’t possibly know what things will look like months down the road.

What’s more, non-voting members of the FOMC also get to place a dot on the chart. However, these are people who will have no say in the Fed’s upcoming monetary policy decisions. Yet their views are represented on the dot plot.

And if that weren’t enough, the dot plot does not emphasize the Fed Chair’s dot in any way. Jerome Powell gets one dot just like everybody else. But it’s a good bet that his opinion will carry outsized weight behind closed doors.

Put it all together, and the Fed’s quarterly dot plot isn’t terribly informative. It’s just a snapshot of a single point in time about expectations of the future. It’s not an accurate forecast for the Fed’s future moves. It’s not a proposed plan, either.

Thus, the market misjudged the probability of a March 2024 rate cut and priced it in prematurely. That’s why we saw the boom from October 2023 through February 2024. And it’s why we’ve seen a steady pullback in recent weeks, as reality around rate cuts has set in.

So why didn’t the Fed cut rates?

The answer for why the Fed didn’t cut rates in March — and why it has been slow to do so — is simple. The economy has held up reasonably well, and consumer price inflation is ticking higher again.

And Powell acknowledged recently that inflation has been more persistent than most “experts” expected. Jeff said exactly this back in his January 3, 2024 issue of Outer Limits:

“The reality is that the two major contributors to inflation — supply chain problems and the labor shortage — have run their course. They’ve been accounted for. And we shouldn’t expect that they will be able to reduce inflation any further.

And the Fed — and any future rate cuts — is not only baked into current market sentiment, the market has overestimated the Fed’s ability/willingness to make such aggressive cuts.

In time, this will result in a huge disappointment once this is understood.

This is the fundamental tension that will define 2024. And it’s the one big story that the mass media has completely wrong. The Fed is in a tight spot. Inflation is here to stay this year…” — Jeff Brown, Outer Limits, January 3, 2024

Had the Fed cut rates last month, it almost certainly would have sent inflation surging higher. And I suspect that there’s a larger play at work, as well…

The global financial system has revolved around the U.S. capital markets for eight decades now. That’s because the U.S. dollar has served as the world’s de facto reserve currency since 1944.

The widespread use of the dollar has provided significant benefits to the U.S. Benefits include the ability to borrow cheaply, fund government spending, and project economic and political influence globally.

But suddenly, there are international factions building their own systems designed to compete with the established financial order. If adopted widely, those systems could eat into the dollar’s dominant market share in global finance.

We don’t need to go down that rabbit hole today. I only bring it up because my read is that the Fed is going to proceed with caution when it comes to rate cuts. Higher domestic rates make U.S. Treasury bonds attractive to international capital — which, in turn, keeps that capital within the U.S. dollar-based financial system.

It’s similar to the dynamic we talked about yesterday when we noted that stocks compete with bonds and other asset classes for capital. Well, it’s the same with global finance.

The dollar-based global financial system suddenly finds itself in a position where it may have to compete with international alternatives. Those alternatives would bypass the U.S. capital markets and the dollar… which could eat into the benefits I mentioned earlier. So it’s in the Fed’s best interest to keep the current system competitive globally.

Again, we won’t go down that rabbit hole today. I just think it’s important to consider that there are international considerations that could feed into the Fed’s decisions going forward.

So… what’s it all mean? What’s going to happen to biotech in this new environment?

The market got ahead of itself in thinking that the Fed would cut interest rates aggressively in March 2024. And the market is finally starting to realize this.

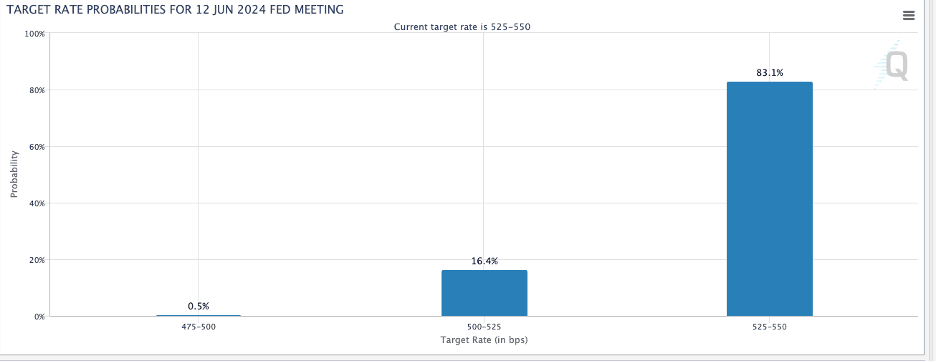

As I write to you, the CME FedWatch Tool — which calculates the likelihood of future monetary policy based on Fed Funds futures — expects only a 17% chance of a rate cut in June.

In fact, it isn’t until September 2024 that “holding steady” isn’t the majority opinion of futures traders. That means the market doesn’t expect a rate cut until at least September of this year.

Remember, these are just expectations. As experienced analysts and investors, we must now apply our experience and data to these expectations.

But if we’re talking about September now… that puts us right into the heart of what will certainly be a heated presidential election here in the U.S.

Remember, the Fed strives to present itself as independent from politics. Do we really expect the Fed to pivot right before the election — especially one everyone is expecting to be highly contentious and chaotic?

Doing so would be construed as overtly political. It would look like the Fed was trying to influence the election, in other words.

Plus, in his most recent press conference on April 16th, Fed Chair Jerome Powell said explicitly that the Fed will likely hold interest rates higher for longer.

He signaled exactly what I suggested earlier — the Fed will be cautious going forward. It’s not going to be quick to start cutting rates again.

So I don’t think a September rate cut is likely at this point. Which brings us to biotech…

We’re confident that biotech has turned the corner. We’ve reached the other side of biotech winter.

But the surge we saw in biotech from last October 2023 through the end of February 2024 was premature.

The pullback we’re seeing now is healthy. And it’s going to pave the way for a true bull market — one not driven by expectations of lower interest rates.

To me, that’s the key. We don’t want to be in a position where we make investment decisions exclusively based on what we think the Fed’s going to do. That’s largely where investors have been… but that dynamic appears to be changing.

The market is gradually waking up to the fact that the Fed is not going to make monetary policy decisions with the stock market in mind going forward.

For institutional investors, that’s something of a difficult pill to swallow. Because the Fed has consistently conducted monetary policy to support the stock market going back to 1987.

We’re in a new climate today. And from where I stand, that gives boutique investment firms like Brownridge Research an edge. We can adjust to changing conditions a lot faster than the institutions can.

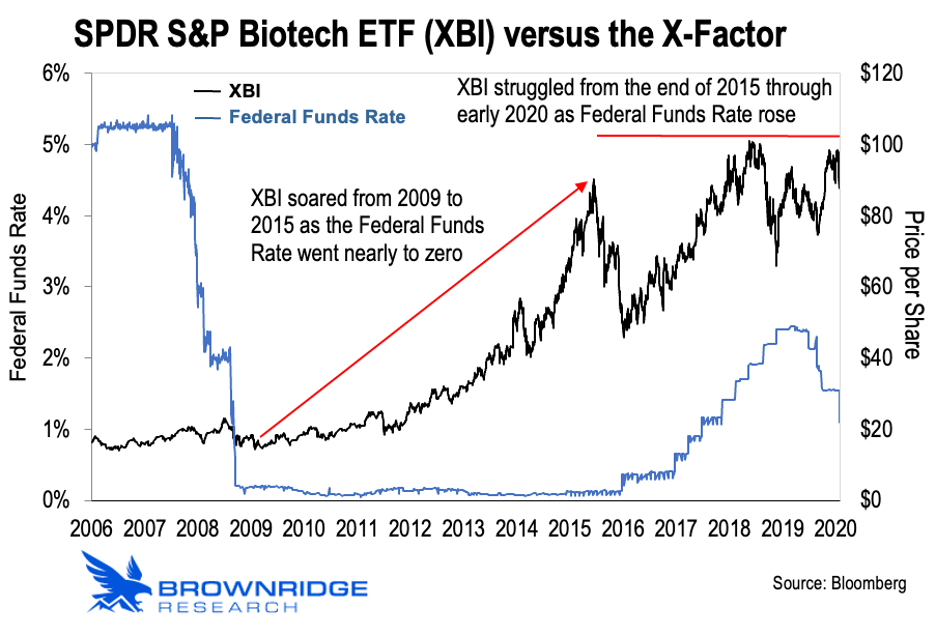

And remember, biotech doesn’t need falling rates to move higher. We can see that clearly in our chart tracking the SPDR S&P Biotech ETF (XBI) and the Fed Funds Rate.

As a reminder, the black line here is the SPDR S&P Biotech ETF (XBI). We’re using it as a proxy for the biotech market. The blue line is the Federal Funds Rate.

We can see that XBI soared from 2009 to 2015 as the Fed cut its target rate to nearly zero. That created a massive tailwind for biotech.

We can also see that XBI experienced a large pullback as soon as the market began to expect rate hikes in 2015. But it found a bottom and began to grind higher after the expectation of higher rates were fully priced in.

Again, it’s all about market sentiment. And right now, the market needs to recalibrate to the fact that interest rates will remain higher for longer than most expected.

I see this as a good thing.

When the next biotech boom does come, we expect it to be a sight to behold. Because the biotech industry has advanced leaps and bounds in recent years.

In many ways, it’s as if the market is still in its slumber about the state of the industry today — completely unaware of the changes within.

Today, biotech companies are leveraging artificial intelligence (AI) and big data to optimize drug discovery. This is going to speed up therapeutic development dramatically in ways that are difficult to perceive — all while cutting costs to a fraction of what they’ve been.

Then there are breakthroughs like CRISPR genetic editing, which is literally curing diseases that were once though untreatable. The Food and Drug Administration (FDA) just approved the first CRISPR treatment for use by patients last December 2023. (Jeff wrote about it right here in Outer Limits — End of an Era in Biotech?)

That’s what truly excites us. The biotechnology companies of today hold the potential to dramatically reduce leading disease-driven causes of death. And it’s one of the reasons why life expectancies — and quality of life — will soar in the years ahead.

That might sound hyperbolic, but the evidence is all there. We just have to let the tech work, uninhibited.

Yet, very little of this potential has been priced into the biotechnology sector. That’s a massive opportunity.

Coming full circle, the biotech boom hasn’t passed us by. To the contrary, the recent surge was just a head fake.

Rest assured, a better buying opportunity is still ahead of us. We just need to let the markets recalibrate to the reality of the current interest rate climate first.

Subscribers can expect more biotech coverage to come. We can’t wait for it…

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.