Readers know I was worried about a pullback last week.

The earnings from artificial intelligence (AI) leaders, ASML (ASML) and Taiwan Semiconductors (TSM) showed us the market was in for a breather. That meant increased volatility.

And volatility came with the market melting down last Friday. The tech-heavy Nasdaq fell 2.1% and the broader large cap index, the S&P 500, fell 0.9%.

The market has bounced back this week, but I’m not sure we’re out of the woods yet…

After an impressive, nearly 30% six-month rally (from its October 2023 lows to its March 2024 highs), the Nasdaq is now 6% off its highs.

Many stocks are down 25%+ from their highs.

That leaves us with one thing to do: Start prepping our buy lists.

Today, we’re going to be looking at three new AI entrants to see if they’re worthy of our list.

In my issue last week, Outer Limits — What Do Earnings Tell Us About the Next Leg of AI, I made the point that AI has been the “market leader” since the end of 2022.

And that will continue to be the case until something more exciting comes along (which is unlikely anytime soon).

So today, we’ll pick up where we left off.

I’m going to talk about three companies that benefit from AI, which had their initial public offering (IPO) in the past 12 months. Are they all hype… or the real deal?

And then I’m going to tell you the most important fundamental factor I’m looking at before purchasing any new AI headlining company.

Arm Holdings (ARM)

Jeff has called Arm Holdings “a gem in the semiconductor industry.” The company designs semiconductor architectures and licenses its designs to other semiconductor companies. As this is highly specific intellectual property, it’s a high-gross margin business.

ARM specializes in power-efficient designs for smaller semiconductors. These are often used in electronics applications where power consumption is important — such as devices on the edge of the network like mobile devices and internet of things (IoT) devices. ARM claims that their technology is in 99% of all smartphones in the world.

But ARM also has a thriving business in licensing IP for data center and AI applications, as well.

Almost every semiconductor company uses ARM’s architectures in one way or another. It’s customers also include Apple, Google, Nvidia, and Samsung — who design their own semiconductors in-house for their own products. The expansion of data centers to run AI applications has helped ARM’s sales.

That’s why this company has gained so much interest in the recent months. And that attention drove the share valuations to what Jeff called “nosebleed levels.” And the higher they go, the harder they fall. Since the peak after Jeff’s warning, the price of ARM shares plummeted 32%.

So what am I looking for to give us a good buy signal? That’s simple, I want to know what Masayoshi Son and Softbank are going to do with the 90% of the company they still own.

We don’t want to be “holding the bag” when Softbank dumps shares on the market. And with the IPO lockup expiring on Mar 12th, Softbank can sell shares any day now.

The Financial Times has reported that Softbank has pledged a 75.01% interest in ARM as collateral for a loan. This is a way for Softbank to access cash from this ownership position without selling any shares.

That’s good news for investors. But I can’t find anything else about the approximately 20% of company shares Softbank could sell. That’s a material amount, as only 10% of the company’s shares trade freely on the markets right now.

Gaining clarity on Softbank’s potential divestment is paramount before buying ARM. I’d like to hear that they either sold lots of shares on the open market and it didn’t move the price much.

Or I’d like to hear they sold these shares to strategic investors such as Nvidia (which wanted to buy the entire company in 2020), Apple, or Intel. Doing an off-market transaction like this would move the stock less than selling on the open market. And a strategic investor like these companies would be less likely to sell than some hedge fund trying to turn a quick profit.

ARM’s business is great. It’s a fantastic company. But the one thing we need to be careful of is Softbank’s exit plan. Look for details on this before purchasing.

Astera Labs (ALAB)

Astera Labs is a $10 billion company that just had its IPO in March 2024. And it was one of the best IPOs of the year, surging 72% on its first day of trading.

It’s up about 100% from its IPO price as of today.

It has held its gains even into this volatile market. So what makes this company so special?

Astera’s products are used for one thing — facilitating the movement of data in data centers, many of which are now processing AI-related software. And as long as that trend continues gaining traction, ALAB will see investor interest.

Data transfer is turning into a bottleneck for AI applications. Google and Microsoft have shown that up to 70% of AI model training time is taken up by just waiting for data to transfer back and forth.

Put another way, those $40,000 Nvidia H200s could be sitting idle 70% of the time — in data transfer mode. It can take hundreds, or even thousands, of those GPUs to train complex AI models. No company wants to have millions of dollars of equipment sitting idle.

Just like we need wider highways for more cars, we need faster data highways. These are called interconnects in the industry. High-performance interconnects allow data to flow at higher speeds over longer distances between processors, memory, and storage.

Astera’s chips and cables help build more powerful and energy-efficient data centers. And its products are in high demand.

We know this because the Securities and Exchange Commission (SEC) requires all companies to submit an S-1 before their IPO. This report specifies exactly what the company does and includes financial reports for at least the past two years.

This report showed our that ALAB’s revenue grew 45% from $80 million in 2022 to $116 million in 2023. It also showed that the company’s net loss declined year over year. That’s shows us that as they make more revenue, they should achieve profitability soon.

The one problem with ALAB is that they have a very high customer concentration. Their top three customers contribute 37%, 24%, and 18% of revenue respectively. If one of those customers decides to get their data transfer needs fulfilled by another company, ALAB is in trouble.

Now, the 37% customer is a distributor, which resells the product. They sell to many different customers, so that revenue is relatively safe and stable. But the other two companies are likely large semiconductor companies like Nvidia or Intel. That makes ALAB vulnerable to their customer whims.

Before investing, I’d like to hear ALAB talk more about the stability of their revenue. And even hear about the detail of contracts — specifically if they are multiyear deals. Hopefully they talk about this on their first earnings call, which is scheduled for the evening of May 7th.

Reddit (RDDT)

Yes, we’re talking about the social media platform where people post their cat videos and memes, and try to pump stocks. But there’s more than meets the eye behind Reddit’s business.

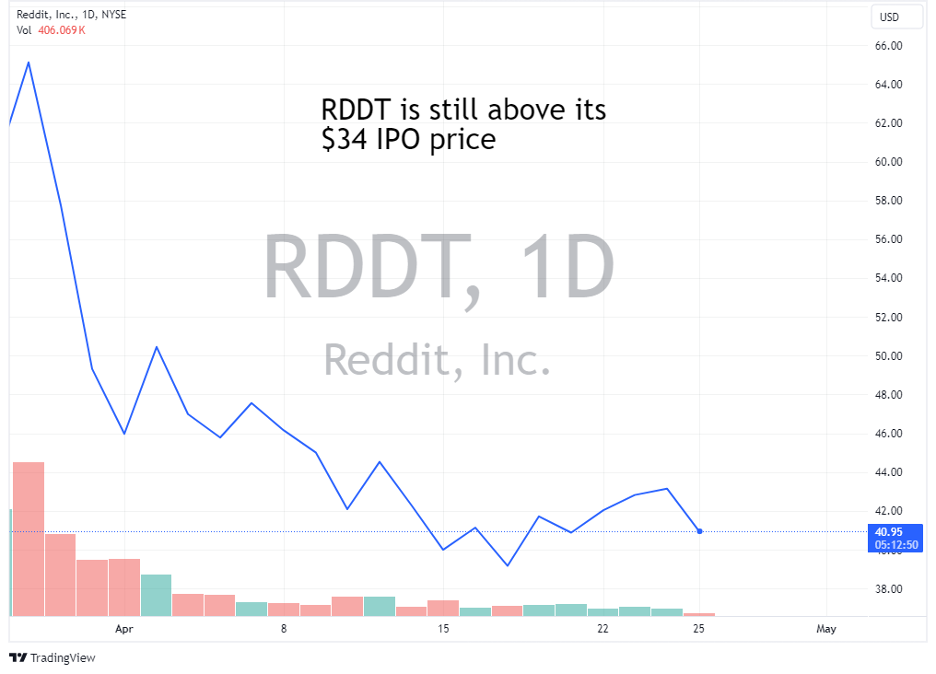

The 19-year old social media platform went public for $34 a share March 21, 2024. The price has pulled back after an initial surge, but still remains above the IPO price. That’s a sign of strength in the stock.

Moving onto the business fundamentals, Reddit is an invaluable platform for up-to-date information.

Sure you can keep up your meme game sharp and practice coming up with witty replies… but that’s only a small part. Reddit has over 100,000 active communities.

One example of how I use Reddit is to do research on cryptocurrency projects. Cryptos are a relatively new technology and it can be hard to find up-to-date information. Especially if the core team doesn’t update their website or white paper regularly.

Many projects set up Reddit communities. The goal is to get developers and users to help each other navigate the technical hurdles of purchasing or staking new cryptos and also the latest information on the projects.

Other people use communities for things like:

This is just the tip of the iceberg. These helpful channels keep the 73 million average daily users coming back.

In the S-1, co-founder Steve Huffman said that advertising is their first business. With that many eyeballs on the page, that’s a no-brainer.

And business is going well for them. In 2023, revenue grew 21% to $804 million. This has been primarily advertising revenue.

But now there’s a new source of revenue coming their way. Reddit’s forums are often the most up-to-date information about certain topics in the world. This create a unique data set for people or artificial intelligences to sift through.

In January, Reddit signed a three-year contract for $203 million data licensing arrangement. This arrangement is widely believed to be with Google.

I believe this for two reasons. First, if anyone regularly uses Google searches, Reddit posts frequently show up in Page 1 of the search results now. This wasn’t the case a year ago.

And also this unique data set is invaluable to training large language models (LLMs) like ChatGPT or Google’s Gemini. Getting this data incorporated into the LLM will make that platform more useful to users.

Reddit expects to recognize a minimum of $66.4 million of revenue this year. This is about 8% of last year’s revenue. And remember, this is just one deal. If they sign a few more, revenue and profits will surge.

Like Astera, Reddit will release its first quarterly earnings report since going public on May 7th. I’d like to hear how progress is going on selling access to their data. If they announce more deals like the Google one, I’ll be very interested in buying shares.

I think companies with unique datasets like this will thrive in the coming years.

I’m looking at a few other companies with unique data sets that are just beginning to sell access. This will be an exciting corner of the stock market soon.

We shouldn’t be scared of volatility in the stock market.

Before making any investment, though, we all should have a plan on how we’re going to handle the inevitable drawdowns.

And during these drawdowns, it’s usually a good idea to add market leaders to your portfolio.

Over the past year, the leaders have been companies enabling the buildout of AI infrastructure. And oftentimes, newly issued stocks have the potential to make explosive moves higher as institutions establish a position. That’s why we looked at these new issues today.

Drawdowns are a time to invest new capital into our favorite companies. That’s what I’m doing. And when we launch an advisory, that’s what I will help subscribers do.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.