Anything — and I mean anything — is being done to gain an advantage.

With trillions of dollars at stake — and the lure of controlling the most powerful technological development in history — it’s no surprise that companies will go to all lengths to gain an advantage.

Clever, over the top, creative, and — some might call — devious deals are being structured to gain control.

A perfect example of this comes in the form of the latest developments at Inflection AI.

Inflection AI is a fascinating story…

One that pushes the outer limits of what amounts to a corporate development shell game. Also known as a sleight of hand.

Two years ago, it was hard not to be excited about Inflection AI. It was founded by Reid Hoffman, the former founder of LinkedIn who affected a sale of the company to Microsoft in 2016 for $26.2 billion.

The deal was done at a remarkably high-valuation multiple of 79-times LinkedIn’s EBITDA (earnings before interest taxes depreciation and amortization). I’m sure that it was impossible to say no to such an incredible price.

Hoffman’s co-founder of Inflection AI, Mustafa Suleyman, came with an equally exciting pedigree.

Formerly the Head of Applied AI at Google’s DeepMind division, Suleyman later took a VP role at Google in charge of AI Products.

Together, the two founders were an easy carrot to raising a ton of capital.

Out of the gate, Inflection pulled in $265 million in 2022, resulting in a $1.23 billion valuation, followed by and additional $1.3 billion last summer.

The vision was to create a personalized AI, built on a large language model (LLM), designed to be immensely helpful and empathetic — a more human-like trait.

It’s pretty easy to understand the mass market potential of a personalized AI with a human feel. It wasn’t a hard sell.

With so much capital and talent, it wasn’t a surprise at all to see that Inflection delivered.

Earlier this month, the company released Inflection 2.5, an impressive product for a company that has only been around for less than 2 years.

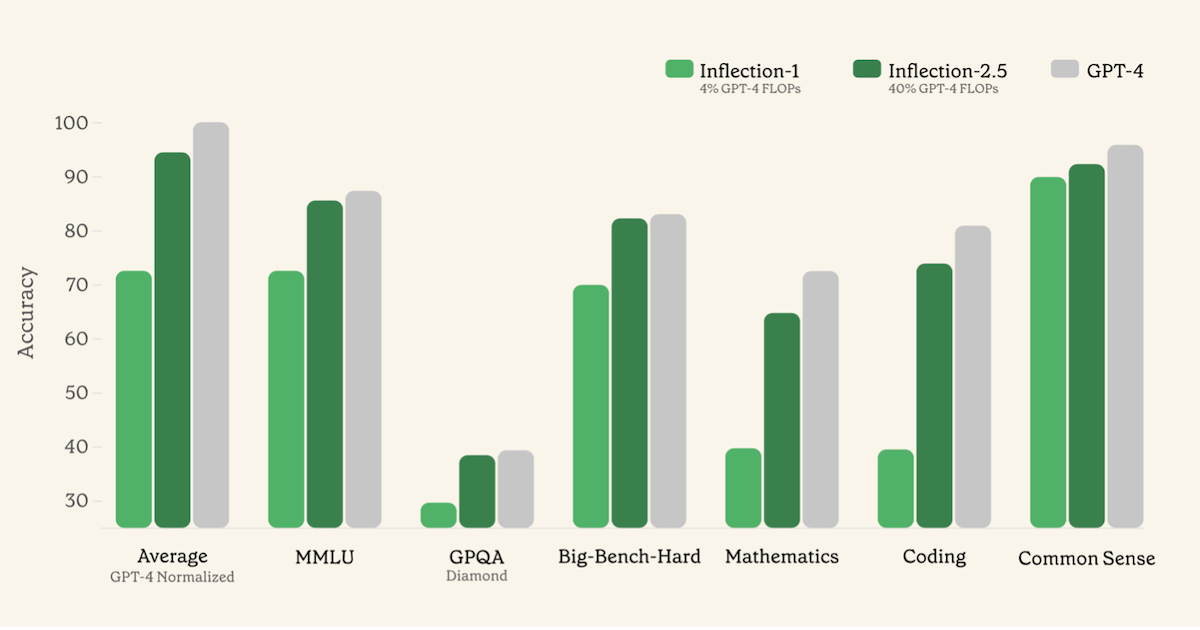

Shown below is Inflection’s latest AI (in dark green) compared to OpenAI’s GPT-4 LLM (shown in gray) across a variety of benchmarks like mathematics, coding, and common sense.

As we can see, Inflection 2.5 performed almost on par with GPT-4, with the added advantage of being an empathetic, humanlike AI — perfect for personalized AI applications.

The breakthrough, however, was that Inflection was able to generate this level of performance with only 40% of the computational costs for training. A powerful AI at the leading edge of LLMs for a fraction of the training cost… what’s not to like?

Inflection also enabled real-time web searches in its product, making the AI up to date with the world’s information, a necessity for a personalized AI assistant.

User statistics for the new personalized AI were already impressive:

Think about that. 10% of all sessions were users chatting with a personalized AI for more than an hour.

There is so much demand for a product like this, something that billions will eventually use daily.

So much incredible potential. And Inflection was on a crazy growth trajectory.

Which is why it’s such a shocker that the company is effectively being shut down.

I don’t want to exaggerate. The details are very important.

But this is one of the most sneaky and fascinating deals I’ve ever seen.

None other than Microsoft has agreed to pay Inflection $650 million, in what it calls a “licensing fee,” that will make Inflection’s personalized AI available for sale on Microsoft’s cloud service, Azure.

And Inflection will take that $650 million, plus whatever remaining cash it has from its last financing round, and pay back its investors at a modest profit.

But wait… why is it a shutdown? Well, firstly because most of the staff from Inflection AI, including Suleyman, have been hired by Microsoft.

In fact, as of last week, Suleyman has been named the CEO of Microsoft AI — put in charge of Microsoft’s consumer AI products and research.

And second, part of the deal between Microsoft and Inflection AI is a legal release by Inflection AI for Microsoft regarding the “acquisition” of so many of its employees. Said another way, Inflection can’t come after Microsoft for “stealing” all of its employees.

Microsoft also provided a healthy line of credit to fund the new Inflection AI (hosted now on Microsoft Azure, remember), which will pay for using Microsoft’s cloud computing services.

All that remains of Inflection is a rebranded company that has become an “AI Studio,” designed to help companies with their generative AI models.

Microsoft basically paid everyone off with the $650 million… to make sure they were all happy and didn’t raise a stink.

All the investors were made whole with a modest profit, and all of the employees were taken care of either at Microsoft or the new Inflection AI. Devious.

That’s why it was $650 million. Hush money. That’s the number that worked.

Why all the sleight of hand? Why the shell game by Microsoft?

Why not just acquire Inflection AI outright?

Regular Outer Limits readers will have already snuffed out the smoke and mirrors.

It was done this way for the same reasons that Microsoft structured its deal with OpenAI.

To try and avoid antitrust issues from regulators.

Microsoft, through its deal with OpenAI, already effectively has control over OpenAI through its $13 billion investment in the company. We reviewed this unique deal in Outer Limits — The Drivers Behind Sam Altman’s Ousting.

Much of the media missed the point, suggesting that Microsoft didn’t need to spend $650 million for Inflection AI to host its service on Microsoft’s Azure cloud services platform. They insisted that Microsoft could just develop its own large language model.

Of course, it could have. But that’s not the point.

Microsoft wanted the entire team that built Inflection 2.5 at 40% of the cost of what OpenAI spent on GPT-4. It also got Inflection’s software through its license fee, so Microsoft can now sell Inflection’s personalized AI.

Microsoft learned the hard way with mobile devices. It was so late to the game, and it tried to push a Windows-like user interface to smart phones… which was a complete disaster.

Meanwhile Google, which developed Android OS, became the dominant mobile operating system worldwide, resulting in a fortune for Google from data surveillance and monetization.

And Microsoft’s embarrassing $7.2 billion acquisition of Nokia’s mobile devices division back in 2013 — almost all of which had to be written off — proved to be exactly the wrong strategy to insert itself back into a massive market.

Microsoft doesn’t want to make the same mistakes again. Especially for a market ultimately worth trillions.

That’s why $13 billion doesn’t matter if it can control OpenAI and have the exclusive license to its LLMs.

And that’s also why $650 million doesn’t mean a thing in the context of being able to “control” Inflection’s personalized AI and “acquire” the team that built it.

Just imagine what they’ll be able to do next, with unlimited capital for research and development.

Microsoft’s end game is simple: It wants its software on every smart phone, every laptop, every desktop, and every enterprise server on the planet. It wants to be everywhere.

And a pervasive personalized AI assistant, used by everyone, would empower Microsoft to employ the same business model that made Alphabet (Google) a $2 trillion company.

New reader? Welcome to the Outer Limits with Jeff Brown. We encourage you to visit our FAQ, which you can access right here. You may also catch up on past issues right here in the Outer Limits archive.

If you have any questions, comments, or feedback, we always welcome them. We read every email and address the most common threads in the Friday AMA. Please write to us here.