I hope you’ve enjoyed our Outer Limits guest essays these past two weeks.

It’s been our absolute pleasure welcoming back both Nick Rokke and Joe Withrow — two of “the boys” and among our most seasoned analysts.

I want to thank them for their expert contributions on the biotech and artificial intelligence spaces this week and last.

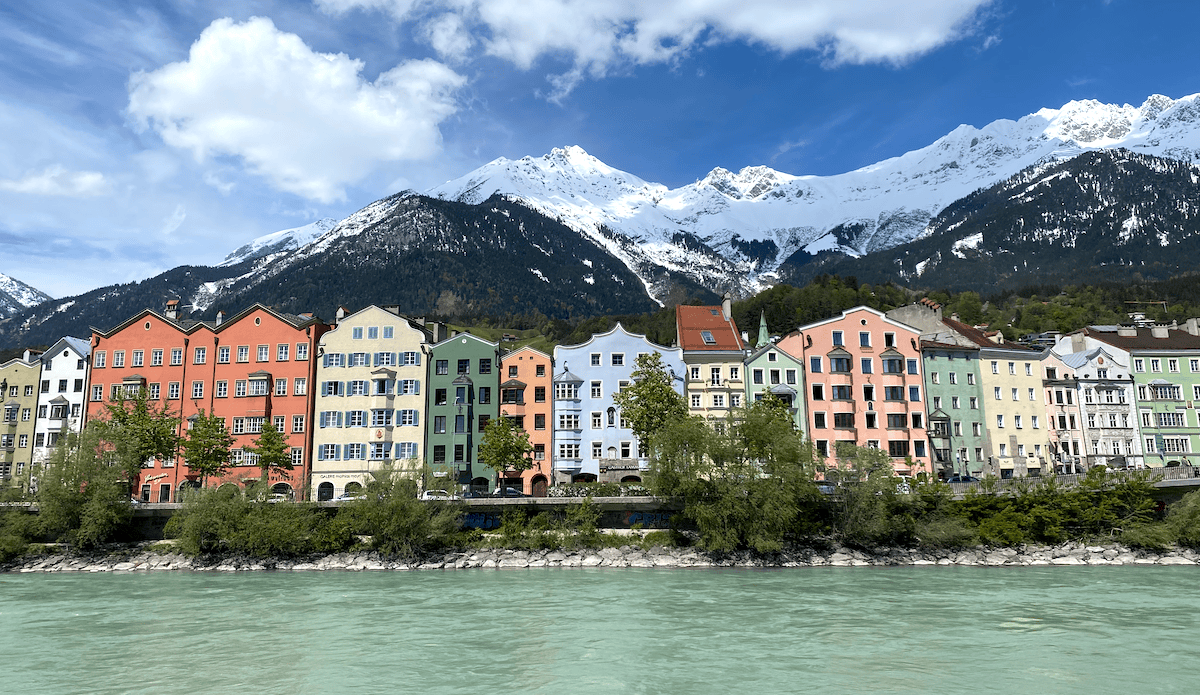

I was just in touch with Jeff. He’s still in the Austrian Alps — about to head to Germany — and will be back at his desk Monday morning…

Though Jeff's travels are coming to a close this weekend, you can expect more from Joe and Nick in future issues.

One more final housekeeping item before we dive into this week’s AMA with Jeff...

We’ve received all your notes regarding Digital Eclipse. We're in touch with the team and will have an update out in the coming weeks.

Thanks to everyone for a great week in the mailbox.

Lindsey

Great article today regarding the biotech industry winter finally thawing. I've been investing in early-stage biotech (pre-seed thru Series A stages) over the past 5 years. A major concern for me is how the COVID pandemic (and the largely failed public policy that developed from said pandemic) has perhaps permanently tainted the promise of mRNA therapies to treat other serious, and in many cases to-date incurable, health problems. Do you have any thoughts to share on the future of mRNA therapies? — Alex P.

Hi Alex,

Thanks for writing in with such a fantastic question. This is worth exploring.

Should we make the assumption that other mRNA therapies will be unsafe and ineffective, like the COVID-19 mRNA “vaccines”?

I (Jeff) believe that almost everyone now understands that COVID-19 mRNA “vaccines” have been completely ineffective. They did not stop infection. They did not stop replication of the virus. They did not stop transmission of the virus.

And they absolutely did not immunize us or provide immunity to the virus.

This is why the COVID-19 mRNA “vaccines” are not vaccines — they are nothing more than experimental drugs that did not undergo standard safety testing prior to injecting the drug in about 70% of the world’s population, more than 13.5 billion doses administered.

This is effectively the largest uncontrolled Phase 1 clinical trial in history.

It has also been the largest medical disaster in history, due to the severe adverse events, which also include death. And it has now become the largest medical coverup in history.

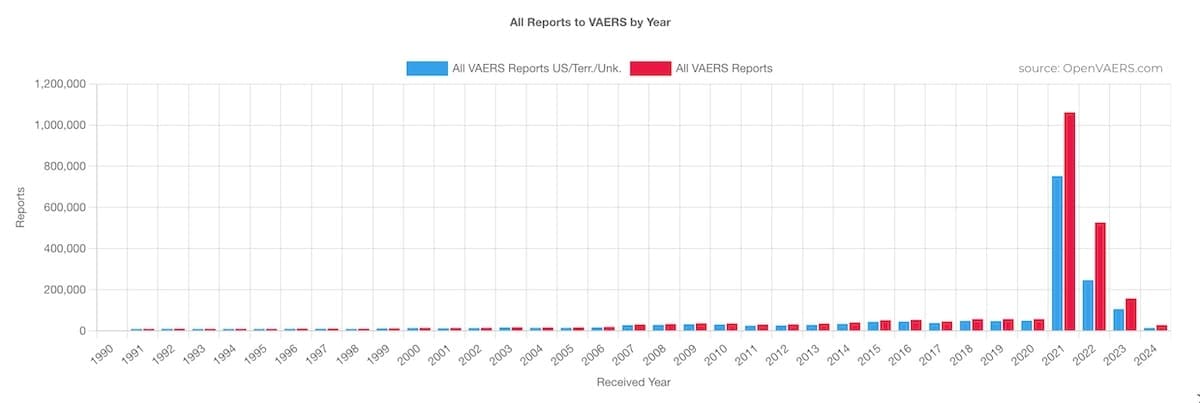

Here’s the latest CDC data from its Vaccine Adverse Events Reporting System (VAERS). Data is through March 29, 2024.

VAERS is the CDC’s system used by healthcare professionals to report adverse events to vaccines. It is not perfect, primarily because there are severe underreporting factors (i.e. it only captures a tiny percentage of actual adverse events, as most are never entered into the system). But it absolutely is an effective signal to alert the medical community that something is wrong.

Through March 29, 2024 there have been 2,596,902 severe adverse events reported, of which 37,382 are reported as COVID-19 “vaccine”-related deaths.

The two most shocking realities about this are:

Of course, this is a disaster on a scale that it almost impossible to understand. And it might be natural for us to attribute that to mRNA technology, but that would be a mistake.

The COVID-19 mRNA “vaccines” were rushed through development, and corners were cut on all aspects of the pre-clinical and clinical development.

The drugs were only designed to coax the human body into making the main spike protein that the COVID-19 virus was known for. The idea was that once our bodies created the spike protein, they would create antibodies to fight the spike protein and thus teach our bodies how to shut down the real virus when exposed to it.

We were falsely told by “experts” that this was safe and effective, and also that the spike protein produced when we took the “vaccines” would not enter organs, would stay local to the injection, and would leave the body in a matter of days. None of that was true.

It is important to note that this is nothing like a polio or tuberculosis vaccine, where the body is exposed to an inactive or weakened virus. Being exposed to the complete virus — in a safe manner — does allow our bodies to gain immunity.

But that is not how the COVID-19 “vaccines” were designed.

The other major problem with COVID-19 mRNA vaccines is that there was incredible variability in the manufacturing of these drugs. Some lots had vastly different concentrations than others, thus causing radically higher incidents of severe adverse events and deaths.

The mRNA “vaccines” were also contaminated with DNA (they still are), which is believed to be largely responsible for the excess deaths that we are seeing in every country that has high levels of COVID-19 mRNA “vaccination.”

The DNA contamination results in the weakening of our immune system, particularly the parts that fight cancer. Said another way, the contamination has resulted in giving cancers free reign to grow, which is why we have been seeing what many in the medical field are referring to as turbo cancers. We’ve also been seeing an explosion in certain kinds of cancers in young populations where cancer rarely presents.

This is all extremely important context, because the design of the COVID-19 mRNA vaccines was faulted, as was/is the manufacturing of these experimental drugs.

My key point — this is not an indictment of mRNA as a therapeutic approach.

I believe that mRNA technology can be used to safely and effectively help the body to produce proteins that help manage or cure a disease. Initial clinical targets are naturally diseases that are well understood and linked to a specific protein.

Clinical trials are already promising, and somewhat ironically, are going through the normal pre-clinical and clinical trial process that has been historically used by the FDA in order to determine the safety and effectiveness of a drug/therapy before approving it as a therapy.

This is certainly an area that I continue to track closely in the biotech industry.

Hi Jeff, longtime lifetime member from Brownstone Research. The "investment winter" we are coming out of almost totally decimated my accounts. Understood that it couldn't have been foreseen without a "time machine," but I'm wondering what kind of effect our November elections might have on any investments we might have underway at that time. Any advice? Thanks to you and your staff for all your 2nd to none research you provide us! — Michael M.

Hi Michael,

I’ve been thinking about this issue a lot. What has me really concerned is that when I look back to January of this year, things have gotten worse, not better.

At the beginning of the year in Outer Limits — 2024 Will Be Chaos — Here’s How We’ll Come Out Ahead, I outlined my predictions and a list of wild cards that I was concerned about in 2024.

While we’re almost in May, my outlook on the year is looking to be very accurate. It’s one of those issues where I hoped that I’d be wrong and things would improve, but unfortunately they haven’t.

The market today continues to be grossly lopsided, with fast institutional money heavily weighted into a small number of large cap stocks — mostly related to artificial intelligence (AI). There will be a correction, it is just a matter of time.

And inflation has been persistent. It is nowhere near being under control.

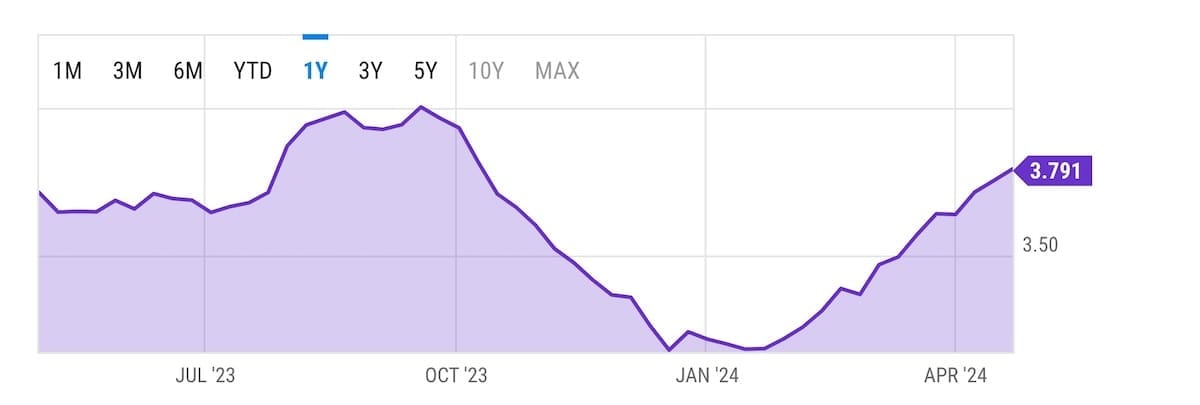

As an example, let’s have a look at average retail gasoline prices in the U.S. Prices have skyrocketed since the beginning of this year. And that’s just the average, at $3.791.

Many places have prices above $5 a gallon, which is exactly what I’m experiencing where I live, as I know many others are, as well.

U.S. Retail Gas Price (I:USRGP)

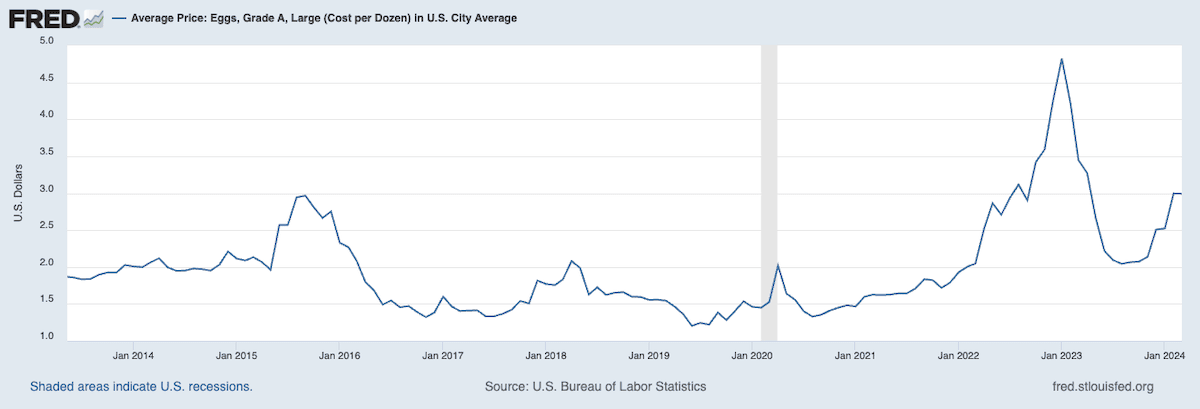

Or how about the average price of eggs in the Midwest? Prices are now at the second highest in history. And again, so many people are paying much higher prices depending on where they live.

And unlike most “experts” predicted, the Federal Reserve hasn’t dropped the Fed Funds rate at all.

For the first time, some are now suggesting that there may be no Fed Funds rate cuts at all this year. Interest rates will stay higher for longer than the “experts” believed.

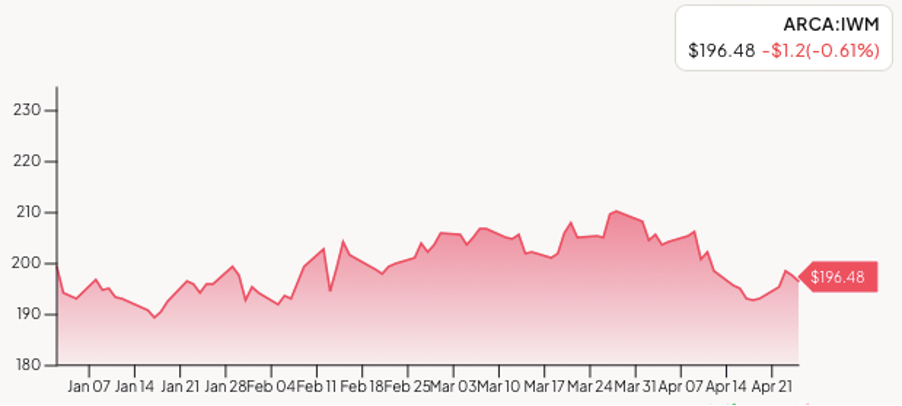

Higher interest rates are terrible for the housing and automotive markets. And they’re also bad for small capitalization growth stocks. We can see the impact of this current environment in the chart below.

iShares Russell 2000 ETF (IWM), Year to Date

The Russell 2000 index is down year to date.

The current U.S. administration is running a forecasted $1.6 trillion deficit for this fiscal year, which is planned to increase yet again to $1.8 trillion next fiscal year.

The U.S. national debt is at an eye-watering $34.686 trillion now, adding $1 trillion in debt every 100 days or so.

Credit card debt is at all-time highs, and regional banks with large exposure to commercial real estate are in trouble.

There will be a reckoning.

And if those things weren’t bad enough already, we have the wild cards to worry about:

Given all of these dynamics, we should be prepared for a lot of volatility this year. Many of these factors that I’ve described above are political and directly linked to the elections.

The open border policy is intentional. City population directly factors into the electoral votes, irrespective of whether or not they are U.S. citizens. And many polling districts in the U.S. do not check for voter ID to vote. This is, of course, completely absurd.

The latest media push this week is the suggestion that the current administration may declare a “climate crisis.” Doing so would give the current administration emergency powers akin to the pandemic. These powers could be used to force mail-in voting, which has already been proven to be highly fraudulent.

All of this doesn’t mean that every asset class with drop — quite the opposite. Select commodities and related companies are very attractive in a market like this. And specific sectors in high-tech are experiencing incredible growth right now and will continue to see that, despite the dynamics described above.

And there will be some excellent shorting opportunities — I have been researching some of the best ways to profit from the volatility that we know is coming.

What this all means is that, for certain high-quality assets, buying and holding and not worrying about the short-term volatility will be a smart approach. And for other asset classes, a more nimble approach will be a better investment/trading strategy.

There will be some excellent buying opportunities. We will be ready for them.

And what happens in 2025 will heavily depend on the elections and the economic, fiscal, and monetary policies that are adopted.

Hello Jeff, a follow up to your information on “Risk of Radiation with 6G.” Do you know of any devices, or products you can put on your phones or in your house, that block or negate EMFs from your phone or other devices in your home? — John K.

Hi John,

I’m glad you asked this. I actually meant to write about some ideas in last week’s AMA.

The reality is that unless we are living completely off the grid — outside the range of wireless networks — and remove any kind electronics that emit non-ionizing radiation from our homes, it is basically impossible to not be exposed to EMFs in normal life. So the question is really about trying to reduce the exposure.

One simple thing that we can do is switch our phones to airplane mode when we get home or get onto any Wi-Fi network. Wi-Fi is “less bad” than transmissions from a 4G/5G/6G network, so this alone will reduce non-ionizing radiation.

For anyone that can live without Wi-Fi, that’s an option to. We can wire our homes with ethernet cable to connect our laptops and desktop computers. That way, we can still be connected.

There are ways to protect our “vital” organs, as well. There is a company called Lambs (https://getlambs.com) that makes underwear and t-shirts that block EMFs.

And as for phones, Bodywell (https://bodywell.com) makes a product that we can stick on the back of our phones that provides protection against EMFs.

Just a few ideas, I hope you and others find that useful.

While 2024 should go smoothly for TSMC as AI chip demand remains strong, the company will face a new competitive threat starting in 2025 as Intel ramps up its foundry business. Intel expects its Intel 18A process, set to be ready by the start of 2025, to be technologically superior to anything TSMC has to offer. (My brother-in-law lives in Phoenix and we saw one of the new foundries being built there. We also have a foundry being built here in Ohio.) TSMC's next-gen 2nm process is in the works, with volume production slated to begin in the second half of 2025. However, TSMC is going to be facing more competition at the high end than it's faced in many years as both Intel and Samsung ramp up investments. How will this competition affect which company would be the best to invest in? — Ron W.

Hi Ron,

Your question highlights some of the most interesting developments in semiconductor manufacturing of the last 20 years.

The CHIPS Act is definitely going to drive onshoring of advanced semiconductor manufacturing, the majority of which we’ll see in Arizona, New York state, Idaho, and Ohio-based on announcements made to date.

I remain very skeptical about Intel’s ability to execute on its current plans. It remains years behind and continues to make one mistake after another when it comes to its new semiconductor designs. I am certain that even if its current plans for 18A succeed on time (highly unlikely), it will still be behind TSMC for the most advanced semiconductors.

And Samsung Electronics’ (the semiconductor division of Samsung) largest customer is Samsung. It is more advanced that Intel, but it is also significantly behind TSMC in both scale and technology.

But the reality is that the industry isn’t just about having the most advanced semiconductor manufacturing process. The most advanced semiconductors are most important for semiconductor applications that are used in mobile devices where both size and power consumption are critically important.

However for most electronics applications, it is not necessary to use the most advanced semiconductor manufacturing process. It is, however, important to have massive scale and incredible quality control. And no company does that better than TSMC.

Due to the advancements in AI, the semiconductor industry is changing significantly. The number of AI-focused fabless semiconductor companies has exploded in order to meet the unique demands for both AI training and inference applications. Almost all of these companies rely on TSMC for manufacturing. That will not change for the foreseeable future.

But the one wild card that we should pay close attention to is when China takes control of Taiwan.

If China decides to place an economic chokehold on the world economy by controlling the output of TSMC to western companies, then we would see a massive shift in the industry.

We would probably also see an incredible buying opportunity for TSMC.

What do you make of the recent hubbub over UAPs (Unidentified Anomalous Phenomena)? I am skeptical that the govt has technology that powerful, which it wouldn’t commercialize. I also feel like there has to be more credible witnesses if this is indeed a real phenomenon involving extraterrestrials — many of the people who speak openly about UAPs have dubious histories and often use it as a jumping off point to other even harder to prove theories. — Jake S.

Hi Jake,

I tend to share your skepticism.

There are so many stories out there, it is very hard to understand what to believe and what to dismiss. And no matter how much digging we do, it’s unlikely we’re ever going to gain access to the truth.

There are also limited investment implications, so this area probably isn’t a good use of my time for my subscribers.

I’d like to believe that at least some of the stories are true, though. The implications are amazing. After all, what bigger question is there, than “Are we alone?”

Had you asked me if I believed that there is sentient life in the universe, I would have answered a resounding “yes!”

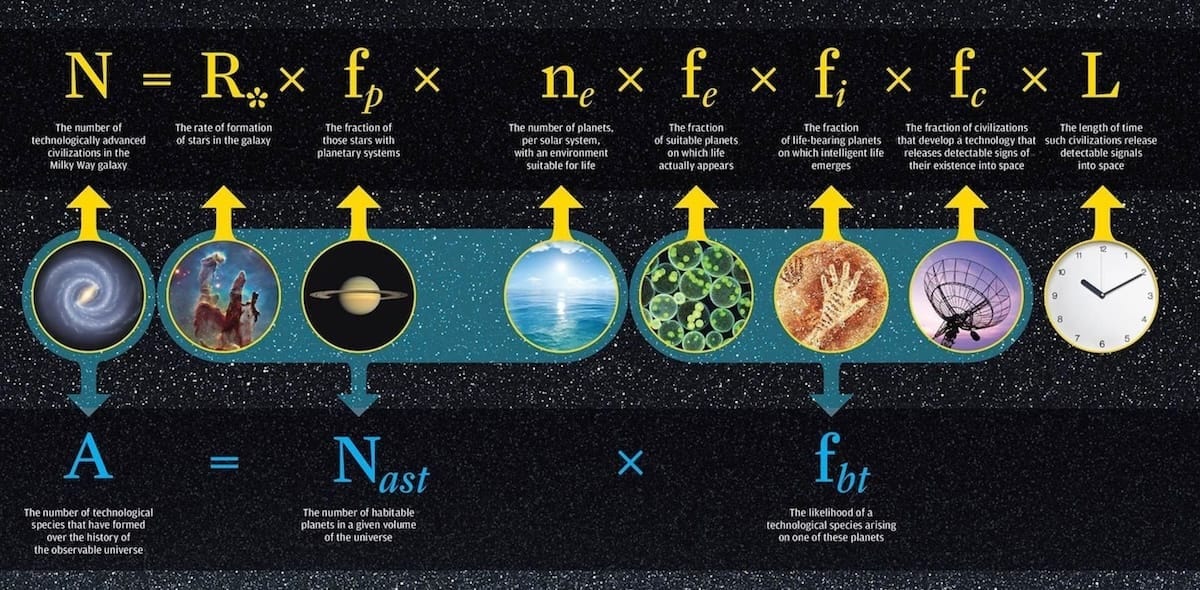

And the reason for that is the Drake Equation. [Note: The graphic may be too small to read, so for those interested, you can go here to see in detail.]

The Drake Equation is simply a way for us to use what we already know of our galaxy and calculate the probability of the number of technologically advanced civilizations in the Milky Way.

In short, it is likely that there are more than 10,000 other advanced civilizations in our “neighborhood.”

But the real problem is that the Milky Way is so vast, it is highly unlikely that we will ever encounter any of them… certainly in our lifetimes. This is even more true if we think about the rest of the universe…

And without technology that can travel faster than the speed of light, or the ability to traverse wormholes, it is likely impossible for us to have first contact.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.