Welcome again to our evolving "Friday" Ask Me Anything (AMA) of Outer Limits.

In the last issue, we dug in on the overall biotech market.

We also revisited the latest on Editas Medicine (EDIT). I shared my thoughts on both the company, as well as some of the exciting happenings in the world of genetic editing.

If you’d like to catch up on these topics, you can do so by going here.

In the short time since, we’ve seen even more great news from the space.

As we learned in the last issue, one of the most recent and positive developments came on November 16, 2023.

The United Kingdom (U.K.) Medicines and Healthcare products Regulatory Agency (MHRA) approved a CRISPR-Cas9-based therapy for the treatment of sickle cell disease (SCD) and transfusion dependent beta thalassemia, which belongs to CRISPR Therapeutics (CRSP) and its partner Vertex (VRTX) therapy.

This was the first CRISPR genetic editing therapy approved by any country. And it didn’t take long for the U.S. Food and Drug Administration (FDA) to do the same.

On Friday, the FDA stepped up and approved the same therapy for use in the U.S. It also approved another non-CRISPR-based gene therapy for sickle cell from Bluebird Bio.

Bluebird Bio’s therapy is priced at $3.1 million, and the Vertex/CRISPR Therapeutics therapy is priced at $2.2 million.

These prices will come as a surprise to most of us — they seem very expensive. And they are…

But the reality is that those prices are less than the lifetime costs of managing the diseases, which are estimated to be between $4-6 million.

This approach to pricing by considering the lifetime costs is quite normal in the industry. Vertex and Bluebird Bio are working to come to an agreement with insurance companies, Medicare, and Medicaid regarding coverage for their therapies.

Aside from the price of treatment, the expected outcomes of the Vertex/CRISPR Therapeutics therapy are radical improvements in health and quality of life.

For example, the very first patient whose sickle cell condition was treated with the CRISPR Therapeutics CRISPR-Cas9 therapy has now gone more than four years without the need of a blood transfusion or any severe pain episodes. All from one single treatment. That’s pretty extraordinary.

For anyone that might be affected by either disease, below is a map of where the treatment centers are located.

If you click on this link, you’ll be led to a page that contains the map, which is interactive. Just scroll down and click on the nearest location to see the name and address of the treatment center.

What a great development to wrap up the year in genetic editing. Far more exciting though is what’s coming next year…

However, for this AMA, we’re going to jump into a couple topics related to blockchain technology and digital assets, as well as the very interesting topic of quantum computing.

I hope you enjoy it…

Jeff

Interested in a few of the stocks you suggested especially regarding quantum computing. What is the thoughts about RGTI, Rigetti Computing? Is this still a leader, especially with Rigetti’s changed role in the company? — Colin R.

Hi Colin, I’m glad you asked about Rigetti Computing (RGTI). This is such an interesting story, at a very interesting time in the quantum computing industry.

Rigetti has had a tough run over the last 18 months. The problem it got itself into was largely due to a gap between expectations set for future revenues, and what actually transpired in 2022 and 2023.

I went back to an old investor presentation in 2021 to review what Rigetti originally forecasted compared to what has actually happened. As a reminder, Rigetti went public in March of last year.

Back in 2021, Rigetti forecast $18 million in revenue for 2022, and $34 million in revenue for 2023. The actual results for 2022 were $13.1 million. And for the last 12 months, Rigetti has reported $14.7 million in revenue.

Rigetti has actually been on a good growth path over the last five years and most recently reported healthy gross margins of 73% for its third quarter.

The real problem was that the gap in revenue expectations was too large. This is not an unusual mistake for executive teams — who are excited about their company’s future — to make.

This is especially true for strong technical founders, as they are better versed in the tech as opposed to the business and forecasting. Chad Rigetti is a perfect example, as he is a PhD and technological founder of the company.

This expectation gap unfortunately led to a decline in institutional interest in Rigetti, which forced Rigetti to remove Chad Rigetti from the CEO role.

The company also carried out a reduction in force in February of this year to reduce costs and extend its runway.

The reality is that Wall Street is hard on small capitalization companies that don’t hit their top line revenue forecasts.

On the other hand, the street is willing to ignore the lack of profitability for a long time, as long as the revenue growth is there.

While this might sound bad for Rigetti, the company has actually been making some great progress…

We just have to put the optics of the expectation gap aside, look at what the company is actually doing, and consider how important its technology has become in the quantum computing industry.

As a reminder, Rigetti is actually a semiconductor company. It might not like me saying that… but Rigetti’s semiconductor technology is at the heart of Rigetti’s quantum computing systems.

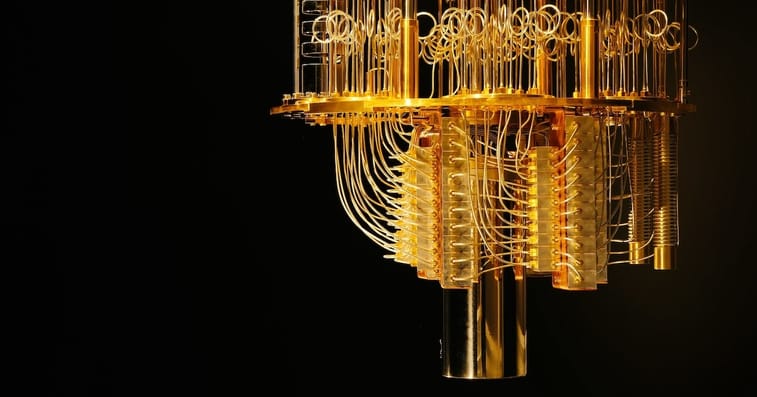

For those who have been following Rigetti the last couple of years, here is an image of Rigetti’s quantum computing semiconductor.

Now, to be fair, Rigetti most certainly is a full-stack quantum computing company.

In fact, it is one of the only pure play, publicly traded quantum computing companies.

One of the biggest technological developments at Rigetti this year was an upgrade of its semiconductor to its fourth generation quantum computing system.

Here is an image of Rigetti’s latest quantum computing semiconductor — Ankaa 84Q — which stands for an 84 qubit system.

This new architecture is a major advance, and one that will improve speed, fidelity, and optimization for error correction.

For those that remember, fidelity is the biggest issue for quantum computing systems.

Low fidelity means too many errors to be useful. High fidelity, combined with error correction, results in quantum computing systems that give a quantum advantage compared to classical supercomputers.

This year was also important for Rigetti from a product standpoint, as it started selling its quantum processing unit (QPU) in the 2nd quarter.

The very first QPU was sold to Fermi Labs, and last quarter it sold another QPU to an undisclosed national laboratory.

The QPU is significant in that it is like selling a standalone quantum computer. This is attractive to many national laboratories and research institutions that want to get their hands on, and experiment with, a working quantum computing system.

The industry is seeing a lot more interest in procuring and working with these early quantum computing systems because the fidelity of these systems has improved so much.

We can think of fidelity as a proxy for “accuracy” of the quantum computer. The fidelity is how close the quantum result is to the intended or expected result.

High fidelity systems are capable of performing meaningful computational tasks that are better suited to quantum computers than classical computing systems.

The current fidelity of Rigetti’s systems is impressive and improving:

The important thing for us to understand is that these are still early days in quantum computing and the above fidelity numbers are very impressive. Certainly a sign of great things to come.

Rigetti’s current guidance is that within 2-3 years, its quantum computing systems will be able to demonstrate nQA, narrow quantum advantage, which Rigetti defines as having a significant price versus performance advantage of classical supercomputer systems. That’s right around the corner in the grand scheme of things.

This is all to say that the fundamentals of Rigetti’s technology remain strong with a clear product roadmap to revolutionary technology.

The company will have somewhere between $88-94 million in cash by the end of 2023, which would provide the company somewhere between 4-6 quarters of operational runway before needing to raise additional capital.

What’s crazy about where Rigetti is trading right now though is its valuation. It is trading at about a $70 million valuation — less than the cash the company has on hand.

Nope, you’re not missing anything. That is ridiculously cheap for such an exciting company. Also worth noting is its enterprise-value-to-sales multiple (EV/Sales) of 4.7.

Just for comparison, let’s take a look at IonQ (IONQ), another pure play quantum computing company.

IonQ uses a different approach to quantum computing called a trapped ion approach. It is an interesting approach to quantum computing that is capable of running at room temperatures and has high fidelity.

Its weakness is its ability to scale at the speed and cost of Rigetti’s approach, which is superconducting quantum computing.

It's very worth noting that Rigetti is not alone in this superconducting approach. None other than Google has focused all of its own research and development on a superconducting approach to quantum computing.

Google announced this summer that its latest quantum computing semiconductor — Sycamore — is capable of 70 qubits (quantum bits). It also reported that it was able to perform a computational task that would take the world’s most powerful supercomputer 47 years to perform.

This summer’s announcement from Google was the most significant announcement since 2019, when it reported that it has achieved quantum supremacy with the earlier version of its Sycamore chip. The latest version is said to be 241-times more powerful than the 2019 version — wow!

I’m noting this because Rigetti is already testing its 84 qubit quantum computing system. This is a very big deal for a small company to be operating at a similar level as a company like Google.

This context was important regarding valuation because of where IonQ is current trading...

IonQ’s valuation is currently $2.4 billion with an EV/Sales of 122. That’s not a typo. Seriously.

And IonQ’s revenues for the last 12 months was $19.7 million compared to Rigetti’s $14.7 million.

How can Rigetti be trading at a $70 million valuation and IonQ be trading at $2.4 billion valuation? It makes no sense at all.

And Rigetti’s approach to quantum computing is basically validated by Google.

If quantum computers can be built with semiconductor technology, they can scale extremely fast, and enjoy the types of cost reductions that are normal with scale seen across the semiconductor industry.

From my perspective, the reality is simple: Rigetti is trading way too cheap, and IonQ is way overvalued at the moment.

Both are good companies with great technologies, and their approaches to quantum computing will likely be used for different applications. In other words, there is room for both.

As we reviewed in the last AMA issue, institutional capital still hasn’t come back into small capitalization stocks, so until that changes, we should expect Rigetti to be a bit volatile.

But if the company isn’t acquired, it has a great future ahead of it. And I fully expect it to be a very hot stock once the interest rates start to decline and institutional capital starts to flood back into high growth small capitalization stocks.

That’s it for today’s AMA. Please continue to submit your comments, questions, and feedback right here. I look forward to the next.