This January, a Delaware judge made a highly unusual and unexpected ruling.

Her decision was to void Elon Musk’s compensation package as the CEO of Tesla.

It was unusual because the compensation package had been established in 2018, approved by both the board and Tesla’s shareholders at the time.

The judge claimed that the “process leading to the approval of Musk’s compensation plan was deeply flawed.” She believed that Musk had too much influence over the board and shareholders, which resulted in what she considered to be excessive compensation.

She even went further by advising that Musk, Tesla’s board, and its shareholders work out how Musk would return his “excess pay.”

At the time of the ruling, his 2018 compensation package was based on stock options, giving Musk the right to buy up to 304 million Tesla shares at a price of $23.34. Based on where Tesla’s share price was trading in January, Musk’s package would have been worth about $50 billion.

That sounds like a massive package, and it is.

But as with most matters, the context is important. And in this case, there is a lot to understand.

In March of 2018, Tesla’s share price had been trading in a fairly tight range since 2013. It hadn’t been going anywhere at all, as indicated in the far left of the below chart.

There was so much negativity about Tesla and Musk’s strategy for the company.

The cries of “Tesla is losing money on every car sold!” were everywhere. “It’s going to zero!” they said. “The debt will bankrupt the company!”

Tesla carried an enterprise value of $54 billion at the time of the approval of Musk’s 2018 compensation package, against annual sales of $21.4 billion. Its valuation multiple was considered overvalued by most, because, after all, “it was just a car company.”

I saw something very different.

And I recommended Tesla (TSLA) in November of that year. It was easily my most controversial recommendation for my subscribers.

I’ve never received so many nasty and polite e-mails from my subscribers, telling me that I was wrong and they wouldn’t ever touch Tesla. Too many “no thank yous” and “you’ve lost your minds.”

That didn’t bother me at all. I knew Tesla was a winner. And I knew I was on to something.

Those that didn’t believe in Tesla didn’t have clear explanations for why. It was an emotional response, not based on analysis and understanding of the technology and Tesla’s strategy.

In my November 2018 issue of The Near Future Report, I outlined my investment thesis in three key points.

First, Tesla’s battery chemistry decisions were strategic for the company. It went against the rest of the electric vehicle industry, designed its own battery technology, and choose a chemistry that greatly reduced the use of cobalt — an expensive and conflict-ridden mineral, most of which comes from the Democratic Republic of the Congo.

Today, these decisions give Tesla a huge competitive advantage both in terms of performance and reduced battery cost.

I said this at the time:

“In fact, the decisions that Tesla made about its battery production have resulted in Tesla having a three- to four-year lead over the rest of the industry.” — Jeff Brown, The Near Future Report, November 2018

Tesla also put in place a $5 billion investment plan in partnership with Panasonic to build out Tesla’s Gigafactory, capable of producing 50 gigawatt hours (50 GWh) of batteries per year. This would enable the production of around 500,000 electric vehicles (EVs) a year.

Again, most thought Musk was nuts and that he would bankrupt the company. They also thought Tesla couldn’t sell that many EVs a year.

The second reason for liking Tesla at the time is because I considered it an artificial intelligence (AI) company — not a car company.

Here’s what I said:

“First and Foremost, It’s an AI Company

When I think about Tesla, I see one of the leading AI companies in the world. Not only does Tesla have the most advanced AI software, it has access and control of its AI network… And that network is its fleet of cars driven by its customers around the world.

This is the incredible part that most don’t see or understand. Tesla designed a software/AI platform designed to operate cars (and trucks). And every one of Tesla’s cars is a “connected” part of its own network.

That’s right, each Tesla car is connected to Tesla via a wireless network, and its “fleet” of self-driving cars is collecting driving data, images, performance data… everything that an AI needs to learn and get “smarter”… every single day.

Real-world data is the single most valuable asset necessary to train an AI, and no other company on the planet has the network in place, nor the data, to compete with Tesla.” — Jeff Brown, The Near Future Report, November 2018

I even showed specifically how valuable Tesla’s “fleet” of cars were for its AI platform.

By the third quarter of 2018, Tesla cars had already collected about 1.5 billion miles of data while driving on Autopilot — the precursor to Tesla’s full self-driving (FSD) autonomous technology.

I compared that to Google’s Waymo, which at the time had only collected about 10 million miles of driving data.

The importance of this, as Outer Limits readers will know well, is that the data is the key to training an autonomous AI. Without it, the technology won’t work. And to get to fully autonomous technology, billions of miles of data would need to be collected.

The third reason I was so bullish on Tesla was because of the implications of its autonomous driving strategy, namely the future ability to enable shared autonomous vehicle (SAV) networks.

This can come in the form of robotaxi networks for which Tesla is planning an August press event for. Or it can come in the form of Tesla owners opting in their Teslas so that their cars can go to work and earn an income for the owner when the owners aren’t using them.

Here's what I said:

“This is the future… shared autonomous vehicles (SAVs). Just like ridesharing companies Uber and Lyft today, there will be networks of SAVs that will be available on demand. Only instead of the car operating as a taxi, users will rent the car to drive themselves… or just ride along while the AI takes the wheel…

And those who own a Tesla will be able to opt in to the SAV network. They will be able to let their Tesla work for them when they are not in use.

After all, on average, cars are only used about 5% of the day, the other 95% of the time they are parked.

Imagine this… You arrive at work in your Tesla, get out of the car, then press a button on a smartphone application that instructs your Tesla to “join the fleet.” While you’re at work, your Tesla is out driving itself… giving rides, earning money… and returns back to your office at the end of your workday.

Imagine that… your car becomes an asset, literally generating income for you every day.” — Jeff Brown, The Near Future Report, November 2018

I recognize how I sounded back in 2018, when the world mostly hated Tesla… and those that loved it only saw Tesla as an electric vehicle maker. I can understand why many readers considered me crazy.

Driverless robotaxis zipping around autonomously — what are we, the Jetsons? I’m sure it seemed out there to many. And even if plausible, it was simply too futuristic to have been an investable idea.

But I think we know what happened.

Tesla rose about 1,600% since my recommendation, when it hit its high in November of 2021. And even where it’s trading today, Tesla is up about 713%.

Why? Here’s what happened.

There’s a lot more. These are just the highlights.

But because of what Musk accomplished with his remarkable vision and persistence, he created $735 billion worth of additional value for Tesla between March of 2018 and December of 2023.

$735 billion in increased valuation of Tesla, when most believed that the company would fail back in 2018.

Elon Musk’s 2018 compensation package would result in him earning about 6.8% of the value that he created for shareholders. Is that unreasonable? I’ll let you decide.

About Musk’s compensation package, a law professor from the University of Virginia said that “it’s not going to create any incentives” for the CEO. Therefore he justified that the package was inappropriate.

That’s embarrassing. And it ignores the fact that the 2018 package was approved by both shareholders and the Tesla board at the time, who clearly felt differently about the motivations of their CEO.

It’s only now that Tesla has been so successful that some are shouting that the package is “inappropriate.” They didn’t care much back when the company wasn’t worth that much.

The judge in Delaware made a major mistake. Executives and founders who want to create immense value for their shareholders — and be rewarded when they do so — will think twice about Delaware as a place to incorporate. They now know that they can have their approved pay packages voided.

But Tesla didn’t give up.

It’s ridiculous, but the board and its shareholders are bringing his 2018 compensation package to a vote… again.

And as of this writing, it sure looks like the shareholders will approve it.

It’s a ridiculous waste of time for the world’s most remarkable innovator.

I’d much rather have him using his genius to keep building remarkable technology that benefits humanity. And he should be rewarded well for creating trillions of dollars of value.

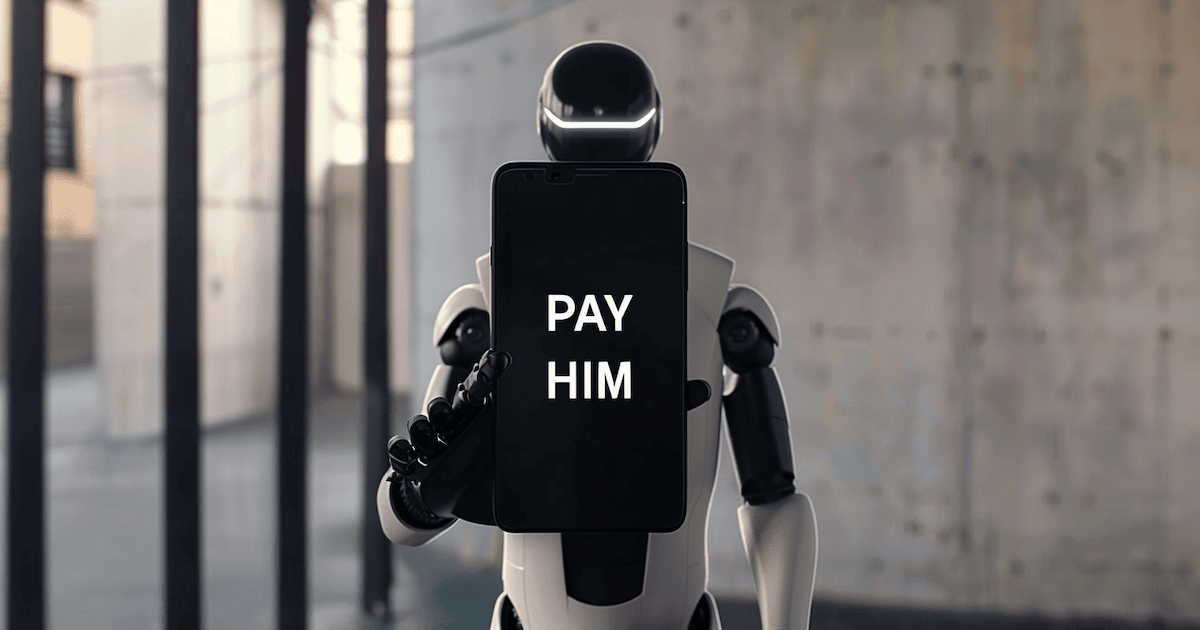

If it were up to me, I’d say:

Pay Him.

We always welcome your feedback. We read every email and address the most common comments and questions in the Friday AMA. Please write to us here.